The biggest recovery in emerging-market bonds and currencies has Russian investors poised to sell, even with oil prices bouncing back.

The ruble’s 5.7 percent rally last week was surpassed only by Ukraine’s hryvnia while top gains for Russia’s bonds pared this month’s declines as five-year yields tumbled 51 basis points in three days to 11.88 percent.

“Pressure on the markets is only rising,” Andres Vallejo, who helps manage the equivalent of $2.6 billion at Kapital Asset Management in Moscow,

said by phone on Friday. He’s getting ready to short-sell local bonds known as OFZs if yields fall to 11.25 percent.

said by phone on Friday. He’s getting ready to short-sell local bonds known as OFZs if yields fall to 11.25 percent.

The investor skepticism underscores doubts the central bank has much more scope to reduce interest rates after 6 percentage points of cuts since January aimed at rescuing Russia from its worst recession since 2009.

“It’s unlikely that yields will fall below 11 percent,” Igor Kozak, the head of fixed-income asset management at TKB Investment Partners in St. Petersburg, said by e-mail. “Probably, this is just a temporary movement and soon we’ll see another wave of selloffs as oil resumes declines."

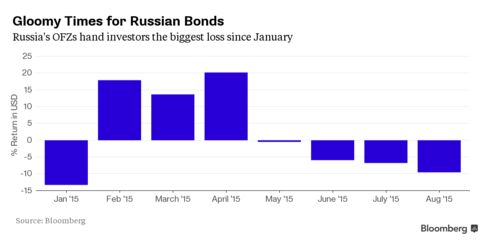

Russia’s OFZs have handed investors a loss of 9.6 percent in August, the most in Europe, the Middle East and Africa, according to the Bloomberg Emerging Market Local Sovereign Index. That’s the worst monthly result since January. Quarter-to-date the currency is still down 15 percent.

Ruble Reprieve

A reprieve last week produced the ruble’s first weekly gain in 10 as crude prices rallied from a six-year low. The ruble added 0.9 percent to 65.402 versus the dollar.

Brent crude surged on Friday to trade above $50 a barrel for the first time since Aug. 13. Oil and natural gas contribute about 50 percent of Russia’s budget revenue.

The bounce-back in oil encouraged Dmitri Barinov at Union Investment Privatfonds GmbH in Frankfurt to close bets OFZ bond prices will drop.

“We may have seen the short-term lows in oil and I expect some stabilization in commodity prices,” Barinov, who oversees $2.6 billion of assets, said by e-mail.

Rebound Fizzles

Now that the ruble’s rebound this year has fizzled, the central bank has little scope to cut interest rates further. But it’s the prospect of U.S. interest rates rising that’s the main threat, according to Konstantin Artemov, a money manager at Raiffeisen Capital in Moscow.

"Of larger importance in September will be not the Bank of Russia rates decision, but the Fed rates decision,” Artemov, who sees yields on ruble debt trading between 11 and 11.5 percent, said by e-mail. “A 25 basis-point increase may trigger another wave of capital outflows from emerging markets, including Russia. And the ruble and OFZs look vulnerable.”