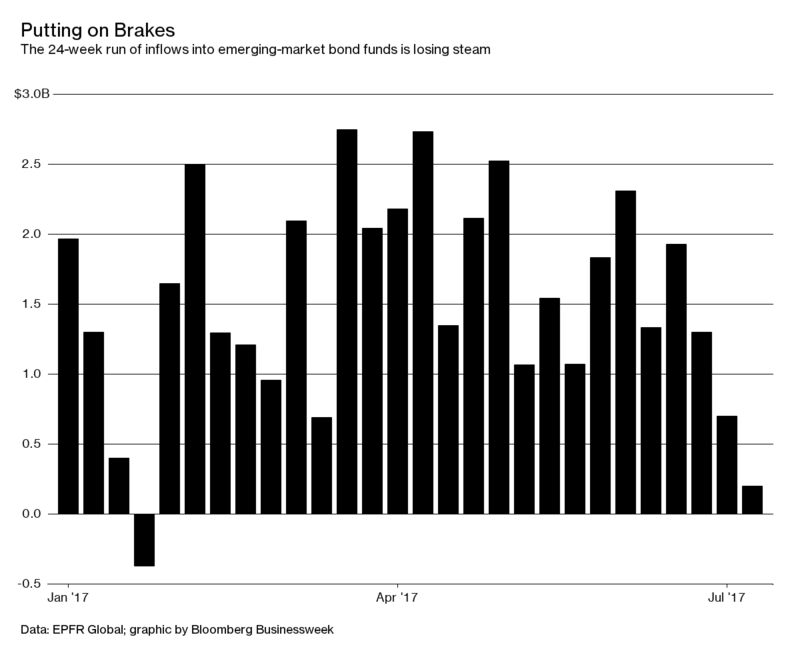

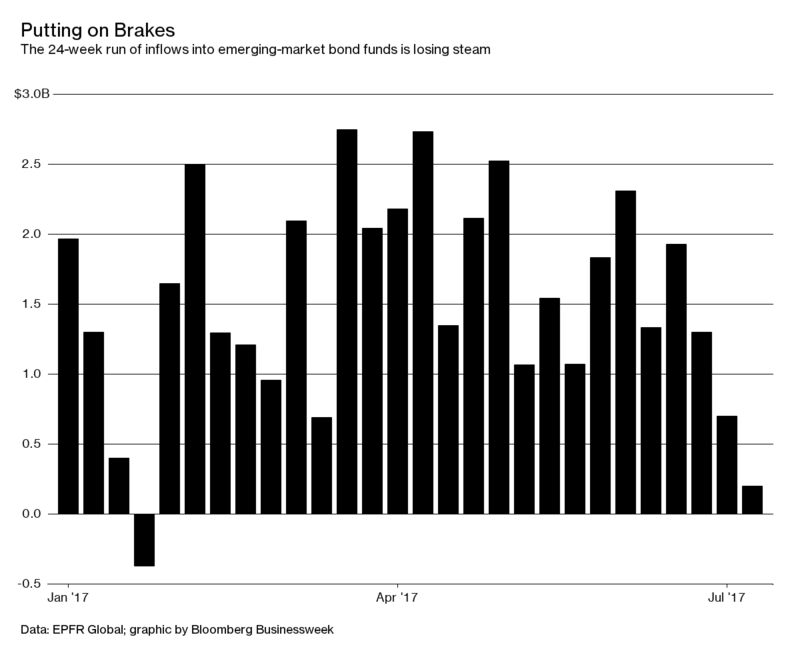

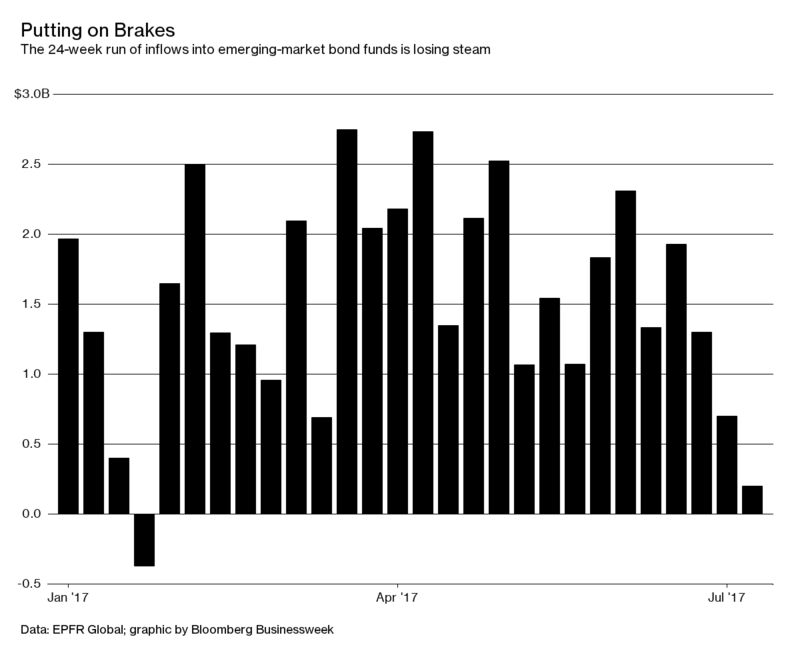

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

Tuesday, July 18, 2017

Bloomberg News - Investor Love Affair With Emerging Bonds Is Losing Momentum

By

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

A 24-week pouring of new money into emerging market bond funds, driven by investors fleeing near-zero yields on developed country debt, is losing steam. Net inflows to the asset class fell more than two thirds to $200 million last week, according to research from Bank of America Merrill Lynch citing EPFR Global data. That’s a third consecutive weekly decline and raises the prospect of an imminent end to the longest winning run of flows in four years.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment