Norges Bank Governor Oeystein Olsen speaks to press after cutting rates in September.

Photographer: Krister Soerboe

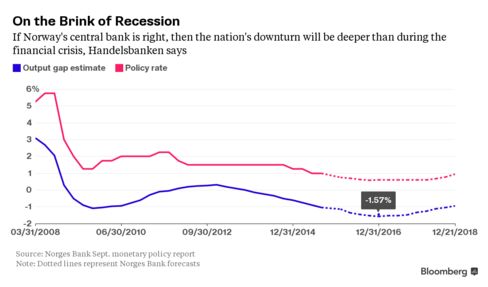

With oil prices still wobbling around $50, Norway is in danger of a recession that could drive its benchmark interest rates, already at a record low, to zero.

That’s what economists at Svenska Handelsbanken AB in Oslo say as they warn that “recessionary risks are significant.” The central bank in September cut rates to 0.75 percent and signaled more than a 50 percent chance for a third reduction since the drop in oil prices accelerated, about a year ago. Handelsbanken sees three cuts next year, bringing the benchmark to zero by the end of 2016.

“The Norwegian economy will now experience a deeper downturn than during the financial crisis, with output expected to stay below its potential for longer than it did last time,” Kari Due-Andresen and Knut Anton Mork, economists at Handelsbanken, wrote in their latest report.

Besides the obvious point that Norges Bank is competing with other banks in the developed world that have cut rates to historically low levels, there are two drivers that could bring Norway’s rates even lower:

1. A krone that just can’t get weak enough.

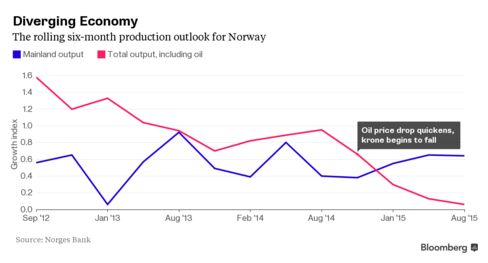

The currency has lost 11 percent in the last year against the euro, driven down by the 43 percent drop in Brent crude to about $48 a barrel. While that has served as a “shock absorber,” buoying exporters and helping competitiveness, weak global demand means the impact of that on GDP has been modest, according to Handelsbanken.

“We can't expect non-oil sectors to meaningfully counteract the oil brake currently hitting the mainland economy,” Due-Andresen says. Further weakening of the krone is dependent on rates at zero, she says.

2. Investments dropping more than expected.

Before the big oil price drop even got started, Norway was already battling a bigger-than-expected fall in investments. Now, with Brent crude lower still, investments by oil and gas companies operating in Norway are set to suffer.

Handelsbanken even sees “new challenges” for the first phase of the nation’s Johan Sverdrup oil field. As the biggest offshore project in decades, the field is providing the nation’s oil sector a lifeline through contracts in the run-up to production, scheduled to start at the end of 2019.

No comments:

Post a Comment