Not since Nelson Mandela walked out of Victor Verster prison 26 years ago have investors been gloomier about South Africa’s economy.

Money is pouring out at a record pace as inflows dwindle. The rand has plunged and unemployment is the highest among almost 40 developing nations tracked by Bloomberg. Drought is driving up food costs. Hanging in the balance is the investment-grade credit rating South Africa sweated to achieve in 2000, shortly after Mandela left office.

South Africans are paying the price not just for a collapse in commodities prices -- metals and mining contribute more than 50 percent of exports -- but for growing questions over whether President Jacob Zuma is up to the task. Stoking doubts were the antics at the finance ministry in December, when Zuma removed Nhlanhla Nene and replaced him with little-known lawmaker David van Rooyen. As bond yields soared and the rand crashed, he changed his mind four days later and installed Pravin Gordhan, Nene’s predecessor.

“The country still faces serious structural challenges, and the changes at the top of the finance ministry just reconfirmed the policy risks,” says Viktor Szabo, who helps manage $12 billion of emerging-market debt at Aberdeen Asset Management Plc. “Things could get worse.”

A key test looms Feb. 24 when Gordhan presents the national budget to lawmakers. He has said the government will do everything necessary to avoid a downgrade to junk, including reining in free-spending state enterprises and sticking to expenditure ceilings.

“The trust towards South Africa disappeared,” said Hakan Aksoy, a London-based bond fund manager at Pioneer Investment Management in London, which oversees 224 billion euros ($244 billion).

Since multiracial elections brought Mandela to power in 1994, the economy has grown an average of 3 percent a year, enabling the ruling African National Congress to provide housing, water and electricity to millions of households and extend social grants to more than 16 million people, while cutting government debt. The country’s benchmark stock index soared to a record less than a year ago, while bond yields fell to record lows.

Since then, the bottom has fallen out. The commodity rout could leave the economy growing at the slowest pace this year since 2009. The country narrowly avoided a recession during the third quarter, posting annualized expansion of 0.7 percent. Fitch Ratings on Dec. 4 cut South Africa’s credit rating one level to BBB-, the lowest investment grade, and in line with the assessment of Standard & Poor’s, which lowered its outlook to negative from stable on the same day.

‘Good Signals’

Gordhan, and increasingly Zuma too, recognize the challenge. In the past month, the finance minister has held meetings with heads of the country’s biggest companies to ask their advice on ways to stimulate the economy, while Zuma promised measures to appease the rating companies, including spending restraints and privatization of some state-owned companies. The rand has recovered some losses, gaining 3.1 percent against the dollar in February after plunging 27 percent in the previous 12 months, and bond yields fell.

While Gordhan’s statements since taking office have been “good signals,” they may not be enough, according Konrad Reuss, S&P’s managing director for Africa. South Africa’s “dismal” growth is the rating company’s biggest concern, while policy will remain under close scrutiny following the replacement of the finance minister, he said.

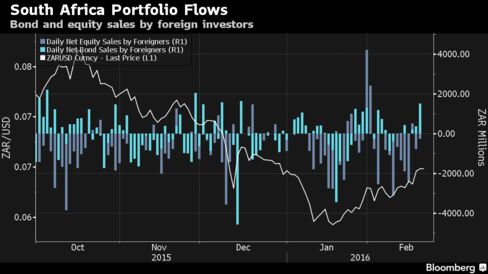

His skepticism is reflected in accelerating capital flight. Domestic investors more than doubled the amount sent overseas to 24.2 billion rand ($1.65 billion) in the third quarter from 10 billion rand in the previous three months, according to central bank data. Foreign investors sold a net 43 billion rand of stocks and bonds in the final five months of 2015; there’s no sign they’re returning, with net outflows this year at 20 billion rand as of Feb. 19.

While South Africa’s hardly alone among emerging-market nations that rely on commodity exports -- Brazil and Russia, among others, have seen their currencies tumble and ratings reduced to junk -- the policy bungles came at the worst possible time. And with local elections looming this year, Gordhan will have to convince investors he can withstand political pressure to increase spending.

“We are likely to remain quite cautious at current prices,” said Kieran Curtis, the London-based director of investment at Standard Life Investments Ltd., which oversees about $436 billion and is underweight South African debt. “The wish list of things that investors have is quite long and not really very achievable with the current political dynamic.”

by Xola Potelwa

No comments:

Post a Comment