Down the cobbled streets of Palermo, past baroque churches and gothic palaces, a lesson is lurking for Italy's government as it hatches a plan to save the country's banks.

Sicily’s biggest city is the focal point of a 2007 securitization of non-performing loans, or NPLs, that shows just how long it can take to resolve soured loans in the country. The deal, known as Island Refinancing, should also act as a warning for investors of the dangers of buying similar securities as Italian banks gear up to sell more of them.

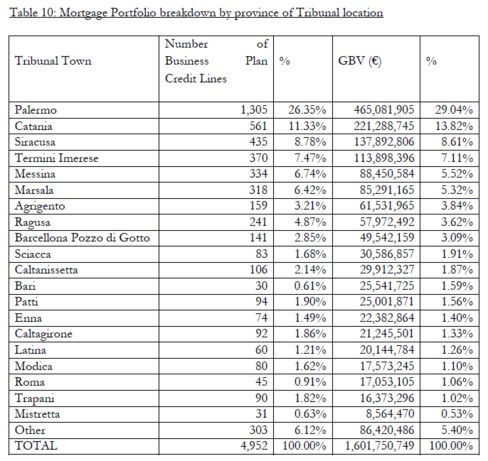

The Island bonds are backed by two portfolios of NPLs originated by a Sicilian bank that's now a subsidiary of UniCredit SpA. Just under half of the loans originated in the 1990s and they include residential mortgages as well as loans financing hotels and industrial buildings.

Source: Island Refinancing Prospectus

Unlike other asset-backed securities where interest and principal are paid through cash flows from mortgage or auto credit borrowers, investors in NPL securitizations depend on getting money back from soured loans — typically through the courts.

And that's where the problem lies. A court may auction the loan collateral and use the proceeds to pay the bonds, but that is a slow process.

Italy is almost as well known these days for its sluggish and cumbersome insolvency procedures as it is for the Leaning Tower of Pisa or the AC Milan soccer club. Italian bankruptcy proceedings last an average of 7.8 years, compared to an average of just overtwo years for the rest of Europe.

Efforts are currently being made to speed up the process, with Prime Minister Matteo Renzi saying recent reforms to insolvency laws will shorten recovery times on NPL collateral to as little as six months.

Efforts are currently being made to speed up the process, with Prime Minister Matteo Renzi saying recent reforms to insolvency laws will shorten recovery times on NPL collateral to as little as six months.

Still, the thus-far glacial pace of cash collections from NPLs has resulted in multiple credit ratings downgrades for the Island Refinancing deal, which will expire in 2025.

The most senior-ranking notes in the securitization — asset-backed bonds are divided into slices of differing risk and returns — were downgraded from an initial AAA grade to AA before being redeemed last year. The notes next in line to be paid were originally ranked A by Fitch Ratings and have since been downgraded to BB.

Fitch last cut its ratings on the notes a year ago when it said the rate of collections had worsened and there was such uncertainty around when funds tied up in Italian courts would be released that it couldn't assume the full amount would be available to pay off the bonds at maturity in 2025.

Last week the ratings company affirmed its previous ratings and said it expects slow collections will result in the default of the 60 million-euro ($66.4 million) class C notes and the write-down of the 32 million-euro class D notes with zero recovery forecast.

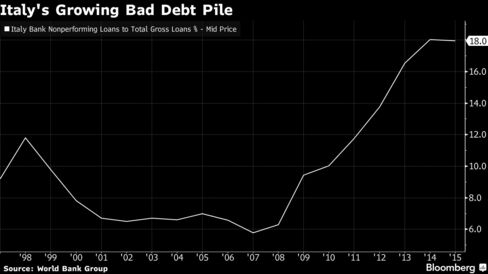

The pain felt by Island bondholders could be a foretaste of broader investor discomfort as Italy works to rescue a banking system burdened with 360 billion-euros of loans past due.

Source: Bloomberg

Securitization of NPLs — the process of taking bad loans from banks' balance sheets and selling them to investors — is a key plank in proposed efforts to help Italian lenders. Some banks can obtain state guarantees on senior-ranking notes under the so-called GACS initiative, while the Atlante rescue fund could be used to acquire junior portions of the debt.

Island is not the only troubled Italian NPL transaction — meet Venus Finance.

The deal is a 2006 securitization of two portfolios of soured loans originated by Intesa Sanpaolo SpA with collateral spread across the country. Like the Island deal, it struggled with timely cash collections and the notes were downgraded multiple times.

Fitch warned last year that with so little cash coming in it was unlikely further principal repayments would be made before the bonds' maturity date in 2019. As if that wasn't bad enough for noteholders, the deal is being unwound and the collateral backing the securitization is being sold after an event of default of the underlying loans occurred when the so-called servicer agreements expired in December — they should have been extended to match the 2019 maturity.

As a result the senior-ranking class A notes in the Venus deal will suffer a significant write-down, while classes B to E will be written off entirely, Fitch said.

Last, but not least, we have Ares Finance 2 — a securitization of NPLs originated by Banca Nazionale del Lavoro SpA, a unit of BNP Paribas SA.

The notes were issued in 2001 and scheduled to mature in 2011, yet in order to allow for more collections to be received the legal maturity was extended to July 2015. And even an extra four years proved not enough to save investors from pain — the 65 million-euro class D notes suffered losses totaling 17.3 million euros.

Italy's elaborate architecture and ancient monuments are an attraction for millions of tourists every year. It's less clear that the country's convoluted court system or byzantine history of NPL securitizations will prove as enticing for investors.

No comments:

Post a Comment