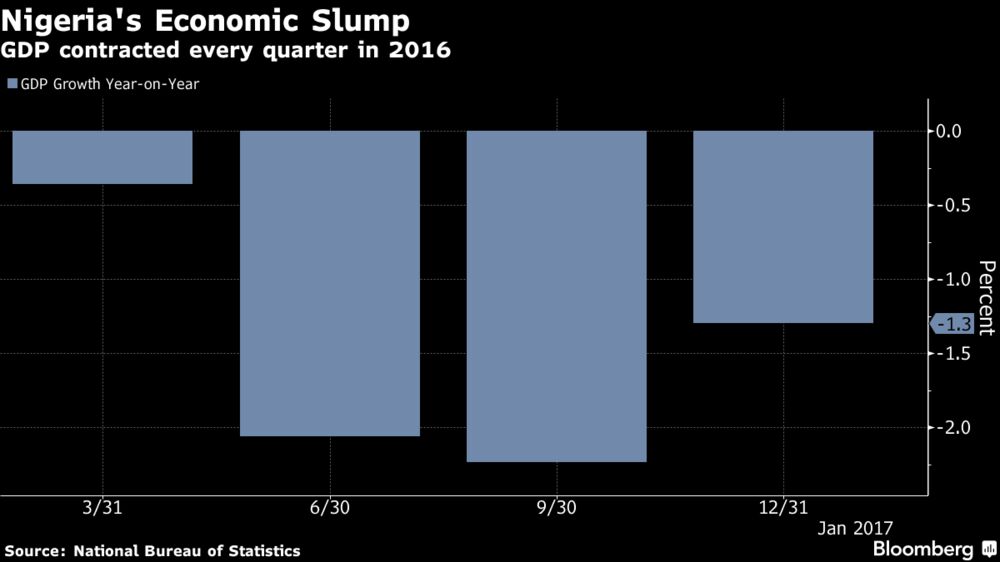

Nigeria’s economy shrank for a fourth consecutive quarter in the three months through December and contracted for the whole year, the first such move since 1991.

Gross domestic product in Africa’s most-populous country declined 1.3 percent in the quarter from a year earlier, after shrinking 2.2 percent in the previous three months, the National Bureau of Statistics said in an e-mailed statement Tuesday. The median of 10 economist estimates compiled by Bloomberg was for the economy to shrink by 1.4 percent. GDP contracted 1.5 percent for all of 2016. It was the first full-year drop in 25 years, according to International Monetary Fund data.

Lower prices and output of oil, Nigeria’s biggest export, cut government revenue by about half and reduced the foreign currency available to import refined fuel and factory inputs. A weakening naira contributed to inflation accelerating to the highest level in more than a decade, prompting the central bank to increase its key lending rate to a record 14 percent. Nigeria’s economic woes were further exacerbated by a five-month delay in approving spending plans for 2016 needed to stimulate business activity.

“GDP was hit by a declining oil sector and a tight foreign-exchange situation,” Pabina Yinkere, the Lagos-based head of research at Vetiva Capital Management Ltd., said by phone.

2017 Prospects

The government said improving crude prices, and the restoration of stability in the Niger River delta -- where militants blew up pipelines, cutting crude production to almost three-decade lows in 2016 -- will help the economy rebound this year. The IMF forecasts the economy will grow by 0.8 percent in 2017.

Fourth-quarter GDP increased 4.1 percent from the preceding three months, the statistics agency said.

Output by the oil sector in 2016 contracted 14 percent from a year earlier, and shrank 12 percent in the fourth quarter from the same period in 2015, the agency said. Oil production averaged 1.9 million barrels a day in the fourth quarter compared with 1.6 million barrels a day in the third.

The non-oil sector contracted by 0.3 percent in the three months through December, and by 0.2 percent in 2016. A decline in real estate, manufacturing, construction and trade weighed most on the non-oil sector, according to the agency.

Currency Shortages

“The poor performance of the non-oil sector is due to weak demand and a crippling foreign-exchange shortage,” according to John Ashbourne of London-based Capital Economics. “Higher oil prices will boost incomes and demand in 2017, but we don’t expect a quick turnaround.”

Vice President Yemi Osinbajo has promised to increase development projects in the Niger delta, including plans to build a $20 billion industrial gas park in the region, and create 250,000 jobs. That, and “resumption of compensation to some of the militants will bring some stability to the delta and increase oil output,” according to Yinkere.

The economy may contract by less than 1 percent in the first three months of 2017, before resuming expansion in the second quarter, Yinkere said. Yvonne Mhango, an economist at Renaissance Capital, and Capital’s Ashbourne predict growth of 0.5 percent and 2 percent this year respectively.

The Central Bank of Nigeria said last week it will increase the supply of foreign currency for Nigerians to pay school and medical fees at an exchange rate not more than 20 percent above the interbank market price. While the regulator removed a currency peg in June, it continues to block importers of items it deems non-essential from the official foreign-exchange market, forcing them to buy dollars on the black market, where the currency is about 30 percent more expensive.

Exchange Rates

Nigeria isn’t “ready to embrace a liberalized exchange rate or depreciation that would prove highly attractive to portfolio investors,” and the spread between the naira’s black market and official rates will probably remain wide, JPMorgan analysts Sonja Keller and Yvette Babb wrote in an e-mailed note to clients before the data was released.

Lawmakers have pledged that they will approve 2017 spending plans next month focused on increasing investments in roads, ports, and power in order to boost factory and farming output. The 7.3 trillion-naira ($23.2 billion) budget has a deficit of 2.36 trillion naira, almost half of which the government plans to plug with foreign borrowing. The state sold $1 billion of Eurobonds earlier this month, and may return to the markets for an additional $500 million.

No comments:

Post a Comment