Investors who bought apartments on the south bank of London’s River Thames hoping to flip them for a quick profit face falling values and declining premiums for new homes.

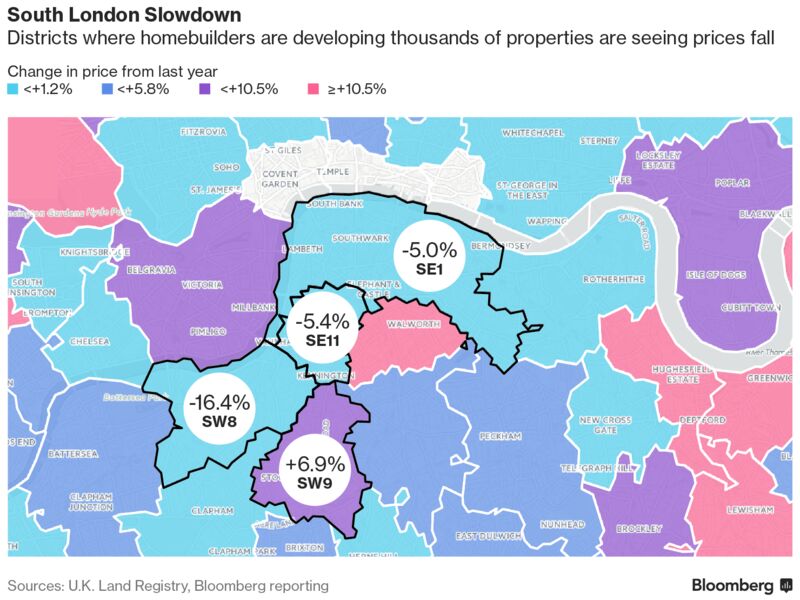

An oversupply of new properties in districts stretching from Tower Bridge to Battersea Bridge produced some of the city’s biggest annual price declines in March. That included a 16 percent drop in the SW8 postcode area, containing the Nine Elms district and Battersea Power Station, according to preliminary data from the Land Registry. In contrast, values in neighboring SW9 -- encompassing Stockwell and parts of Brixton -- jumped 7 percent.

“I expect values to fall further in the Nine Elms area after a huge amount of supply came -- and is still coming -- at the wrong price,” Neal Hudson, founder of research firm Residential Analysts Ltd., said in a telephone interview, “Investors have dried up and the bulk of demand for London homes is now from owner-occupiers who can only afford” to pay 450 pounds per square foot.

The Nine Elms homes are priced between 750 pounds and 1,500 pounds a square foot, he said. The apartments are often sold with facilities including gyms, swimming pools and 24-hour concierge services.

London’s property market has been buffeted by successive tax increases that penalize investors and uncertainty caused by the Brexit vote. Sales of London luxury homes under construction last year dropped to the lowest since 2012, leaving developers with a record number of unsold properties, according to data compiled by Molior London. U.K. house prices fell for a third month in May, the worst streak for the market in eight years, according to Nationwide Building Society.

Almost 20,000 homes are planned for the Nine Elms district, a regeneration site that extends from Lambeth Bridge in the north to Chelsea Bridge in the south. Slowing sales and falling values have caused developers there to reduce return targets, sell units in bulk at a discount and even switch from building larger homes in favor of smaller, cheaper units.

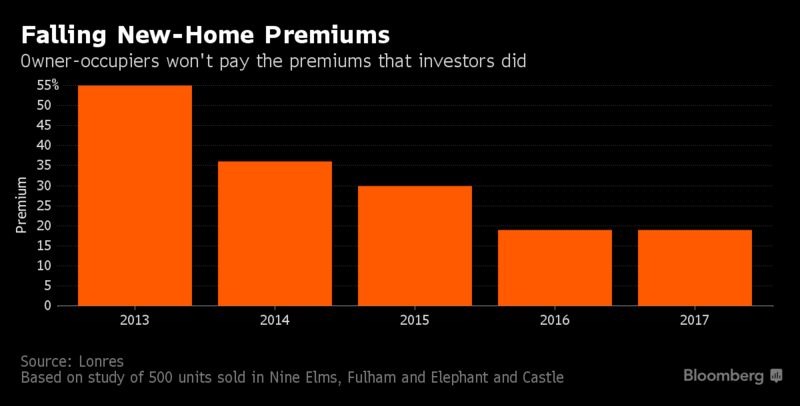

The premium that buyers are prepared to pay for a new home in Nine Elms, Fulham and Elephant & Castle, as opposed to a similar existing property in those areas, has dropped to 19 percent from 55 percent at the end of 2013, according to Lonres. The research firm analyzed 500 newly built properties in 10 developments in those areas that were bought off-plan and resold by investors after completion. Prices for existing homes in Nine Elms, where most of the transactions took place, have risen by an average of 43 percent over the same period.

“These properties were planned and built with foreign investors in mind. Since those buyers dried up, developers are increasingly having to fight to attract owner-occupiers who won’t pay a big premium for a brand-new home,” said Marcus Dixon, head of research and data analysis at Lonres. “Sellers still need asking prices to fall further to get to a level that owner-occupiers are happy to pay. We’re not there yet.”

No comments:

Post a Comment