When bitcoin broke into public consciousness in 2013, it couldn’t have been sexier: a digital currency being used to buy everything from drugs to cupcakes. Now there’s a new wave of excitement about an aspect of bitcoin that is a bit less sexy: public online ledgers. Blockchain — the technology used for verifying and recording transactions that’s at the heart of bitcoin — is seen as having the potential to reshape the global financial system and possibly other industries.

The Situation

After years of volatility, the price of bitcoin reached a new high in early 2017, a surge tied in part to increased interest in China, where bitcoin is seen as protection against currency controls. But efforts to bring investing in the digital currency into the mainstream were set back when the U.S. Securities and Exchange Commission rejected an application to open a bitcoin-based exchange-traded fund that would have opened the field to more retail investors. Meanwhile, more than 50 banks including Barclays Bank Plc and JPMorgan Chase & Co. have joined the R3 consortium, created to find ways to use blockchain as a decentralized ledger to track money transfers and other transactions. R3 has made its software code publicly available, which could hasten its broader adoption. Nasdaq Inc. is already using blockchain — with help from startup Chain.com — for trading securities in private companies. The Australian Stock Exchange is working with blockchain startup Digital Asset Holdings to speed up its clearing and settlement services in the cash equities market. Blockchain is also being tested by retailers like Wal-Mart Stores Inc. for ensuring food safety, as industries ranging from healthcare to natural-resource management are exploring what advantages the technology might hold over traditional databases. Meanwhile, ether, a newer digital currency tied to the etherium blockchain, began to take a bigger share of the cryptocurrency market, and more than 40 new types of digital coins were issued in the first five months of 2017.

The Background

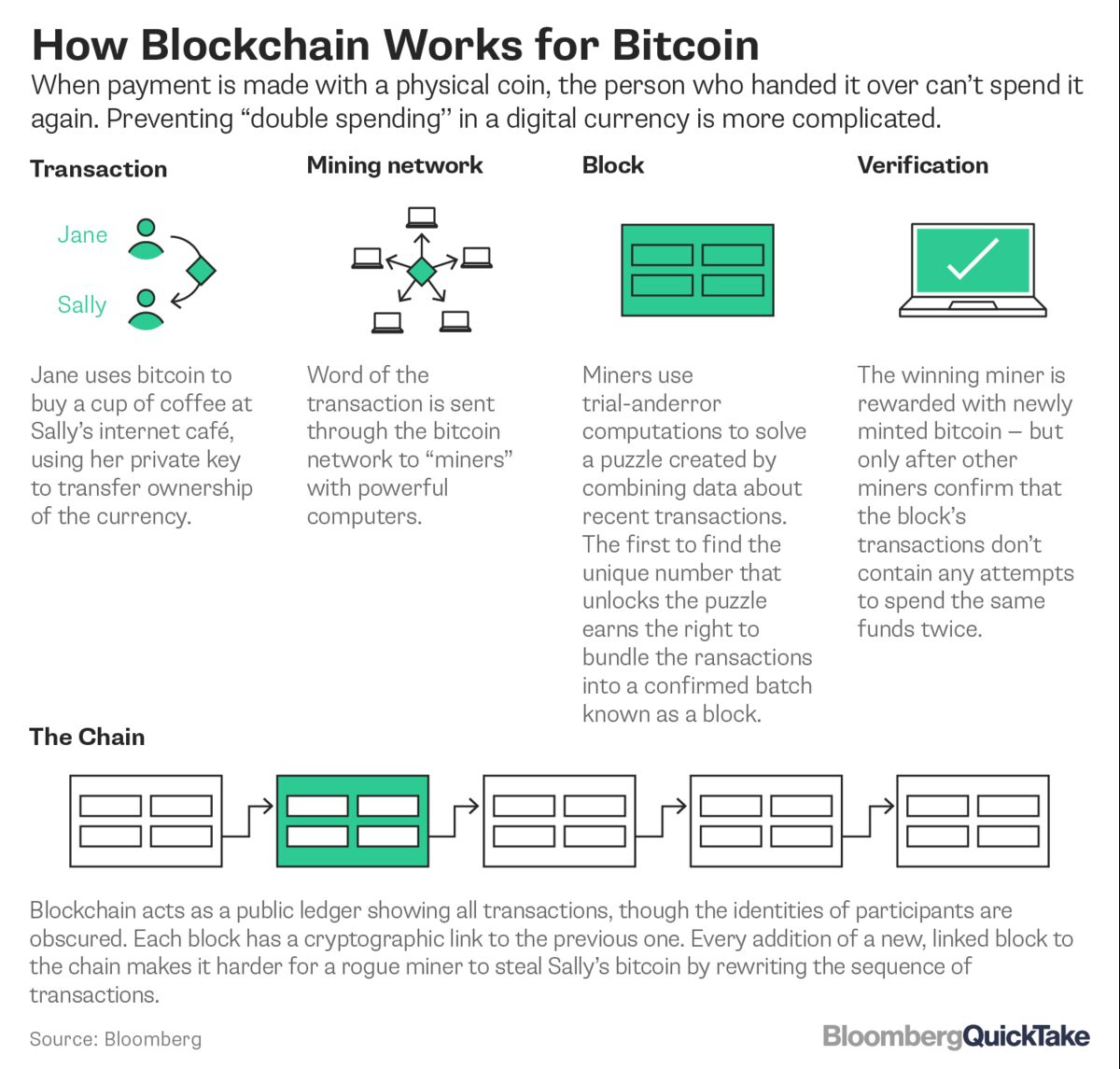

Virtual currencies aren’t new — online fantasy games have long used them — but the development of a secure digital currency without a central issuer rightly turned heads. The person or people who created the bitcoin system under the pseudonym Satoshi Nakamoto solved a problem central to any currency —preventing counterfeiting — and did it without relying on a government’s authority. The software also solved one specific hurdle for digital money — how to stop users from spending the same unit of currency twice. The breakthrough idea was blockchain, a publicly visible, anonymous online ledger that records every single bitcoin transaction. It’s maintained by a network of bitcoin “miners” whose computers perform the calculations that validate each transaction, preventing double-spending. The miners earn a reward of newly issued bitcoin. The pace of creation is limited, and no more than 21 million will ever be issued.

The Argument

Since bitcoin first boomed, there’s been no shortage of critics to call its rise a bubble and to argue that the currency has no intrinsic value. But entrepreneurs in the field say that focusing on the price of bitcoin is missing the point — its value is as proof of concept for a new kind of payment system not reliant on third parties like governments, big banks or credit-card companies. Promising applications of blockchain include moving money abroad, signing contracts, clearing complex financial transactions and as a medium for micro-payments in emerging countries. Others say blockchain advocates are hyping what amounts to no more than a new kind of database. Proponents of ether respond that the etherium blockchain does far more than let bitcoin users send value from one person to another. Its advocates think it could be a universally accessible machine for running businesses, as the technology allows people to do more complex actions in a shared and decentralized manner.

The Reference Shelf

- A Bloomberg Businessweek article looking at how interest in blockchain is surpassing that in bitcoin.

- Bloomberg Television has a video primer as part of its “The 12 Days of Bitcoin” series

- Bloomberg Markets traced the interest of Silicon Valley investors in bitcoin.

- CoinDesk has a Bitcoin price index; Bitcoincharts.com has a range of data.

- Two explainers, one aimed at kindergarteners and the other a you-too-can-mine-bitcoin project, plus an exploration of the double-spending problem.

- The New Yorker looks at Dark Wallet, a project meant to speed the spread of bitcoin, from the law student who invented the printable gun.

No comments:

Post a Comment