Piotr Skolimowski

Photographer: Jasper Juinen/Bloomberg, Photo Illustration: Tom Hall/Bloomberg

If Mario Draghi is worried about the strength of the euro, he’s hiding it well for now.

The European Central Bank president has shirked any invitation so far to bemoan the recent appreciation of the single currency in the style of his predecessor Jean-Claude Trichet, who used to complain about “brutal” moves that risk damping growth. Instead, Draghi has pointed to prospects for a stronger-than-anticipated recovery, suggesting he might tolerate the euro’s gain as proof that his campaign to revive the economy is returning results.

“A lot of central bankers take the view that if the currency rises for good, solid, fundamental reasons then it’s not worth standing in the way,” said Steven Bell, chief economist at BMO Global Asset Management in London. “The reality is that the growth outlook in Europe has changed dramatically --- the economy is growing strongly -- so some currency strength is only to be expected.”

That reality is founded on healthy domestic spending and investment, making the recovery less vulnerable to any damping impact of a stronger euro on exports. Inflation, which the ECB is struggling to return toward 2 percent, may be less well insulated against currency gains and their effect on the price of imports.

Economists in Bloomberg’s latest monthly survey cut their forecast for 2017 inflation in Germany, the region’s largest economy, to 1.6 percent from 1.7 percent. They maintained their euro-area prediction at 1.5 percent.

Policy makers can assess the impact of the euro’s 12 percent jump this year when they start their discussion about the future path of quantitative easing in September. New economic forecasts will be published at that time.

Draghi has limited his commentary on the euro to a few seemingly untroubled words after the Governing Council’s last meeting:

“The repricing of the exchange rate has received some attention during the various exchanges of views, and in various ways.”

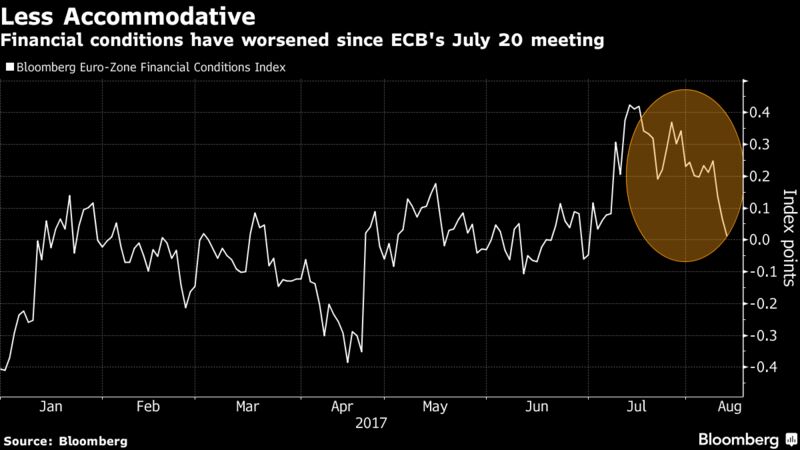

But since that July 20 meeting, when he argued that financing conditions remain supportive of a pickup in price growth, they have deteriorated.

The last leg in the euro’s ascent started on June 27, when Draghi said in a high-profile speech that reflationary forces were at play, arguing that a continued recovery would allow the central bank to scale back stimulus.

Since then, the currency has strengthened 4 percent against the dollar -- reaching its highest since before QE -- and more than 7 percent in trade-weighted terms. Similar gains in 2007 triggered a warning by then-ECB President Trichet that “brutal moves” are never welcome. (The euro traded at just under $1.50 at the time, compared with less than $1.20 currently.)

Draghi has previously attempted to talk down the euro, when he expressed “serious concern” about the currency’s appreciation in May 2014. He has an opportunity to alter his present assessment after his vacation, when he addresses a conference in Germany on Aug. 23. He then heads to the Federal Reserve’s Jackson Hole symposium -- the venue where he put the ECB on course for large-scale asset purchases three years ago.

“Back in 2014, there were concerns the ECB is not doing enough and inflation is low,” said Hetal Mehta, senior European economist at Legal & General Investment Management Ltd. in London. “This time around, what we are seeing is that everyone is expecting the ECB to start tapering next year and they haven’t really done a lot to push back against those expectations.”

Economists predict the ECB will start phasing out asset purchases over nine months starting in January, and financial markets are pricing the first rate increase for late 2018.

For Ken Wattret, an economist at TS Lombard in London, the current market moves are reminiscent of those observed in the run-up to QE. The euro tumbled in the second half of 2014 in anticipation of large-scale bond buying, only to stabilize and even strengthen once the central bank started the program.

Under that theory, pressure on the euro -- amplified by investor uncertainty about U.S. politics -- would ease once officials reveal their strategy to unwind stimulus.

“They don’t want to push the currency up much further,” Wattret said. “But they are probably thinking that, as long as they manage the communication of tapering relatively well, probably the impact on the exchange rate from this point will be more limited.”

Policy makers’ sanguine attitude so far toward a potentially intricate problem suggests that they’re convinced that the euro’s strength reflects economic fundamentals, and that solid, broad-based growth will eventually deliver inflation below, but close to, 2 percent.

“Silence on the currency at these levels is probably a good thing,” said BMO’s Bell. “Bear in mind that the euro zone has a current-account surplus, growth is improving, unemployment is falling and indeed you don’t want to precipitate any thermonuclear comment from Donald Trump to have a go at Europe.”

— With assistance by Fergal O'Brien

No comments:

Post a Comment