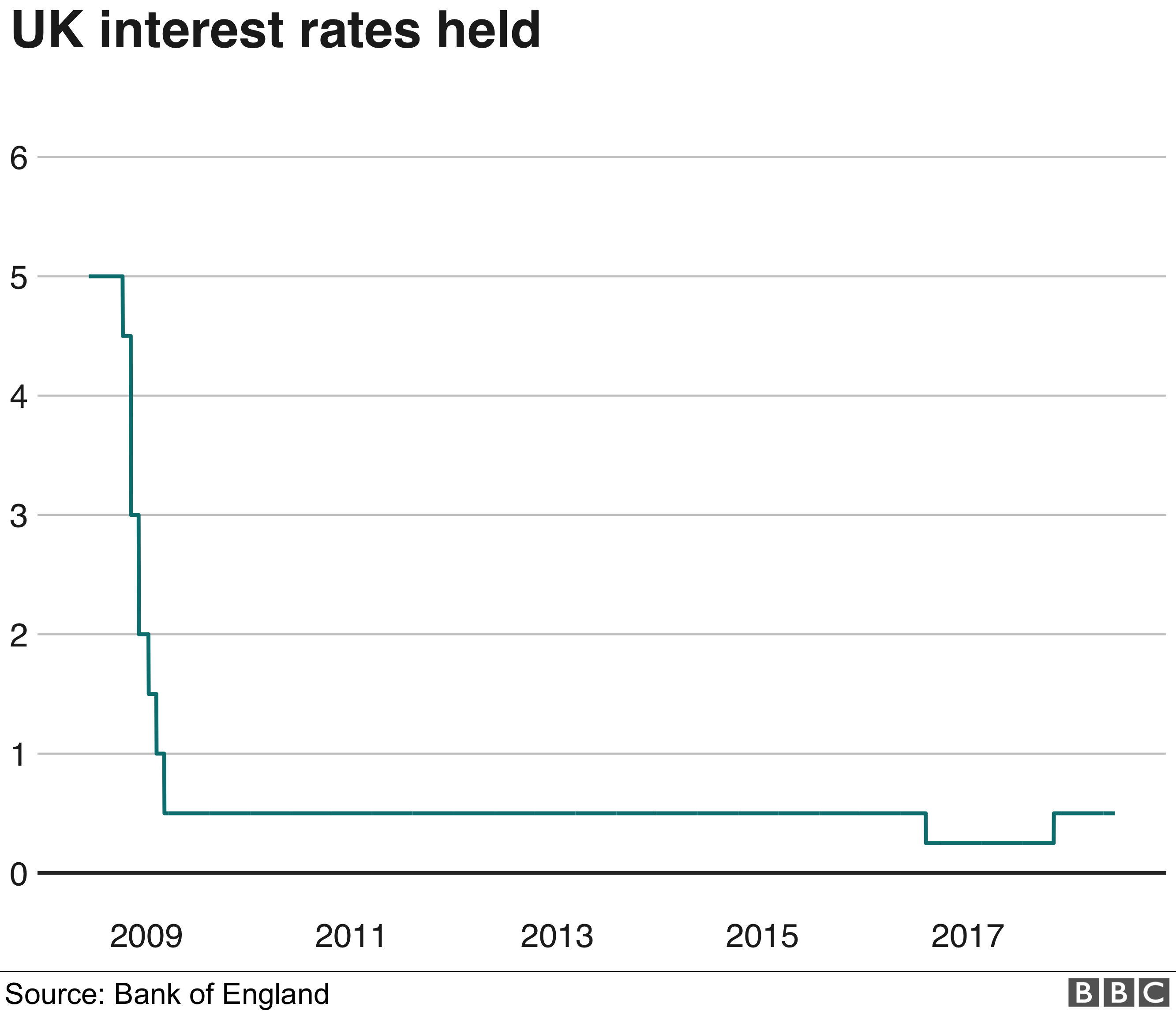

The Bank of England has held interest rates but signalled an August rate rise is more likely than previously thought.

In a decisive move, Andrew Haldane, the Bank's chief economist, joined two other Monetary Policy Committee members in voting to raise rates to 0.75%.

The nine-member MPC was split 6-3, with Bank governor Mark Carney leading the group who voted to hold rates at 0.5%.

The last time three people "dissented" from the overall view, in June 2017, rates rose the following November.

But economists believe that if the economy does show signs of picking up, an August rise is in play. Government borrowing figures published on Thursday boosted hopes among some economists that the economy may be gaining momentum.

The pound jumped by about a cent against the dollar following the Bank's decision, climbing back above the $1.32 level, as the possibility of an August rate rise appeared to increase.

- UK borrowing falls more than expected

- What exactly is the Bank of England interest rate?

- Hammond: Taxes will rise to pay for NHS

The MPC said that the poor economic growth figures of the first three months of a year was likely to prove "temporary" and that the speed of growth would pick up.

As economic momentum improves, fears over rising inflation grow and pressure increases for interest rates to rise.

The level of interest rates is the Bank's main tool for controlling any increase in prices.

"A key assumption in the MPC's May projections was that the dip in output growth in the first quarter would prove temporary, with momentum recovering in the second quarter," the committee said.

"This judgement appears broadly on track.

"A number of indicators of household spending and sentiment have bounced back strongly from what appeared to be erratic weakness in Q1 [January to March], in part related to the adverse weather.

"Employment growth has remained solid."

The MPC said prospects for global growth also remained strong, despite some weakness across Europe.

It is the first time Mr Haldane has "dissented" from the majority view on the MPC since he joined the Bank in 2014 and is significant given his role as the leading economic expert at the institution.

Before today's decision the markets were split 50/50 on whether there would be a rate rise at the MPC's next meeting in August.

After the news that Mr Haldane has joined those pressing for a rise - MPC members Ian McCafferty and Michael Saunders - it is likely the market expectation for a rate rise will strengthen.

No comments:

Post a Comment