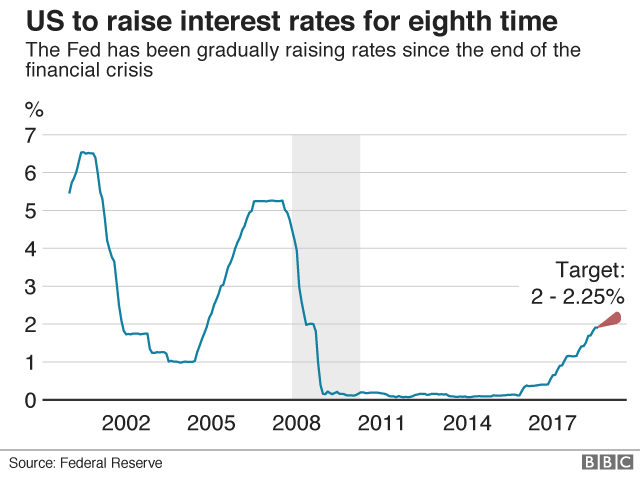

The Federal Reserve has been gradually raising interest rates since 2015

The US Federal Reserve has raised interest rates again.

Officials increased the target for the bank's benchmark rate by 0.25%, to a range of 2%-2.25%. A majority of members also said they expect another rise before the end of the year.

The move marks the bank's eighth rate rise since 2015, continuing its policy of gradual rate rises.

Now investors are looking for clues about how high the Fed might go or signs its pace could accelerate.

So far, US interest rates remain relatively low, reflecting the Fed's decision to lower them dramatically during the financial crisis in an effort to encourage borrowing and boost economic activity.

But Federal Reserve Chair Jerome "Jay" Powell and other economists say today's economy is strong enough that such stimulus is no longer necessary - a shift the Fed marked on Wednesday by ending its description of its policy as "accommodative".

Mr Powell said Wednesday's rate rise reflected the Fed's confidence in the US economy, describing it as a "particularly bright moment",

But he acknowledged that the bank is hearing a "rising chorus of concerns" from businesses about the risk from new US trade tariffs, which have disrupted supply chains and led to retaliation against US exports.

Mr Powell warned that a permanent shift to a "more protectionist world" would hurt the US and global economies, but added that for now, he expects the overall economic impact to remain relatively modest.

"We don't see it in the numbers," he said at a press conference in Washington after the meeting.

US gross domestic product grew at an annual pace of more than 4% in the second quarter of this year, and the unemployment rate continues to hover below 4% - near historic lows.

Price inflation, which had been sluggish, has also started to pick up, hitting the Fed's 2% target - and exceeding it by some measures.

Fed officials now expect the US economy to grow by 3.1% this year - faster than the 2.8% forecast in March, according to projections released after the meeting.

Their predictions for inflation remained unchanged at around 2%.

The forecasts show Fed officials expect about three rate rises in 2019 and one more in 2020, which would lift the bank's important federal funds rate to about 3.4% that year.

Higher interest rates make borrowing more expensive, slowing economic activity and curbing price inflation.

There have already been slowdowns some sectors in the US, such as home and car sales, where higher interest rates have led some price-conscious consumers to pull back.

But Mr Powell said the US economy has successfully absorbed the increases so far, performing better than expected.

AFP

AFP

Analysts worry that raising rates too quickly could tip the economy into recession.

The increasing rates have also faced attacks from US President Donald Trump, who has broken with tradition by commenting on monetary policy.

On Wednesday, he repeated those attacks, saying he would prefer to be able to borrow more cheaply.

"I'm worried about the fact that they seem to like raising rates," he said. "We could do other things with the money."

Mr Powell said the US economy has successfully absorbed the increases so far. He said the Fed does not factor politics into its decisions.

Wednesday's rate rise "yet again demonstrates the Fed's faith that it can continue to raise rates gradually without slowing economic growth", said Kully Samra, UK managing director of Charles Schwab.