GETTY IMAGES

GETTY IMAGES

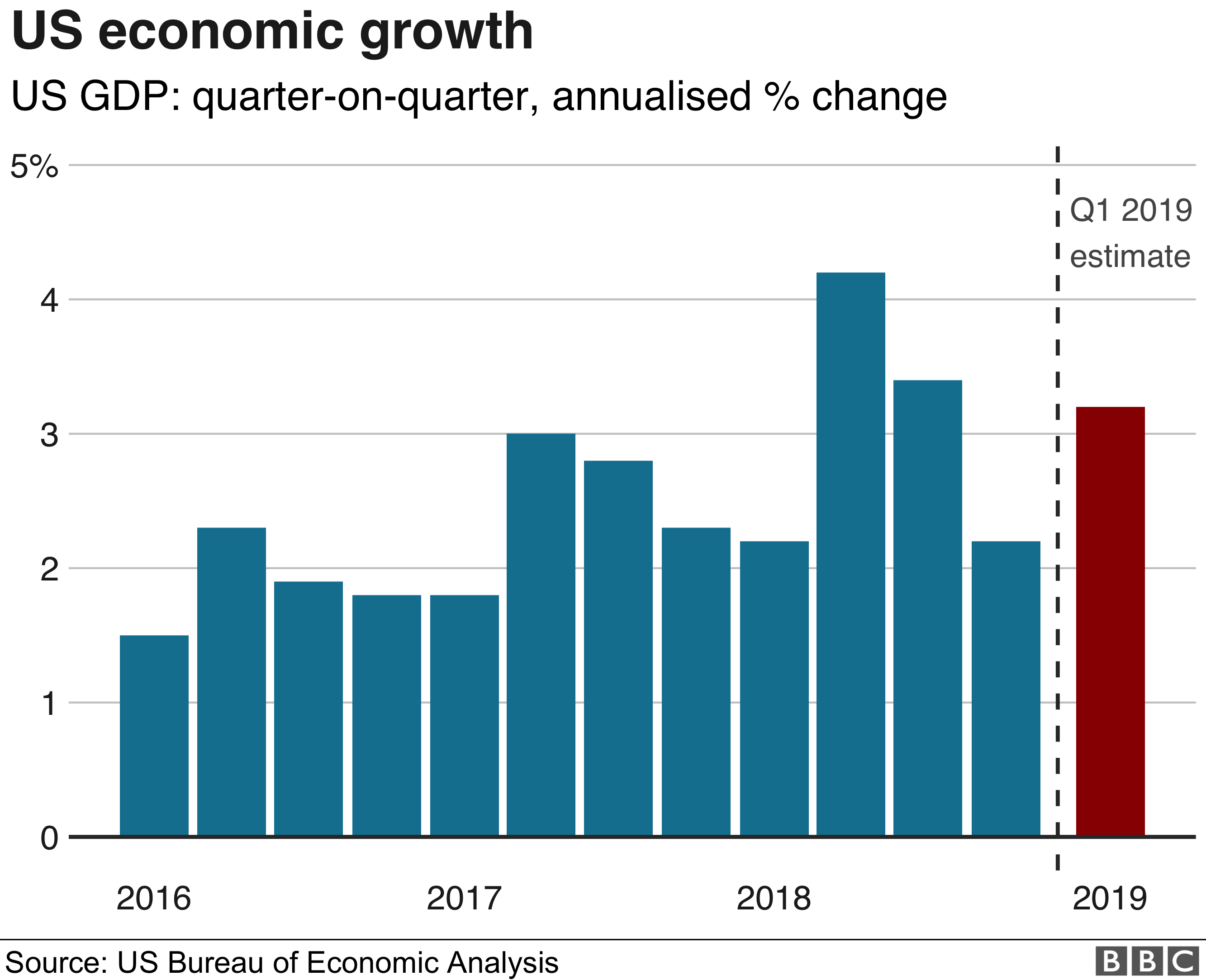

The US economy grew much faster than expected in the first quarter of the year, helped by a jump in exports and by firms building up stocks of goods.

The economy expanded at an annualised pace of 3.2% in the January-to-March period, well above analysts' forecasts.

The economy has accelerated since the previous quarter, when it grew at a pace of 2.2%.

However, some analysts warned growth had been boosted by one-off factors, and could slow in the months ahead.

The growth figures - which are subject to revision in the months ahead - appeared to dispel any fears of an economic slowdown.

Secretary of Commerce Wilbur Ross welcomed the data, saying: "The Trump economy has repeatedly defied the sceptics who predicted an economic downturn and has restored America's position in the world as a consistent source of economic growth."

Trade helped to boost growth in the first quarter, as exports rose while imports fell. Companies also built up inventories of goods at the fastest rate since the second quarter of 2015.

However, consumer spending, which drives about two-thirds of economic activity in the US, grew by only 1.2% in the first quarter, down from a rate of 2.5% previously.

Analysis:

By Andrew Walker, BBC World Service economics correspondent

GETTY IMAGES

GETTY IMAGES

The growth figure was quite a surprise and it certainly defuses some of the warnings about a possible recession in the US.

There were, however, some features of the figures that suggest the headline growth rate is a little flattering. The acceleration owed something to companies building up their stocks of goods. That is a process that won't go on indefinitely, not at the same rate.

There was also a contribution from government spending and from international trade. The last of these is striking, in the context of the increase in global trade tensions due to a significant extent to the more assertive policies pursued by the Trump administration. Will that be sustained?

Consumer spending is a traditional source of US economic strength. It did grow in this period, but more slowly than before. Spending on goods actually declined, although that was more than offset by services.

All that said, some observers point out that the first estimate for this quarter tends to be revised upwards. So we could yet end up with an even stronger figure.

Fed faces 'tricky summer'

Earlier this month, US President Donald Trump called on the US Federal Reserve to cut interest rates, claiming that the Fed had "really slowed us down" in terms of economic growth.

In March, the Fed had indicated that it did not plan to raise interest rates - which currently stand between 2.25% and 2.5% - for the rest of 2019.

Ian Shepherson, chief economist at Pantheon Macroeconomics, said the "strong" GDP report meant the Fed could have a "tricky summer".

"The problem for the Fed now... is that if growth continues at anything like this pace, the labour market will tighten much further this year, and the question of rate hikes will be back on the agenda".

However, Paul Ashworth, chief US economist at Capital Economics, warned that there were "plenty of causes for concern" behind the headline growth figure.

As well as the boost from trade and inventories, he noted growth was also lifted by government spending on highways and roads.

"So taking out the over-sized boosts from net trade, inventories and highways investment, which will all be reversed in the coming quarters, growth was only around 1.0%," Mr Ashworth says.

"Under those circumstances, we continue to expect that overall growth will slow this year, forcing the Fed to begin cutting interest rates before year-end."

No comments:

Post a Comment