GETTY IMAGES

GETTY IMAGES

Rising fears about the health of the global economy have prompted talk of recession, spreading anxiety about jobs and growth.

The US-China trade war is casting a shadow over the world economy and warning signs of a looming downturn have flashed on financial markets.

Recession poses no immediate threat to the biggest economies in Asia, although they are slowing down. Yet some smaller economies in the region - including Hong Kong and Singapore - are definitely at risk.

They are what Louis Kuijs, head of Asia economics at Oxford Economics, calls the "innocent bystanders" in the trade fight between Washington and Beijing.

"These are small, open economies, where trade - and trade with China - is extremely important," says Mr Kuijs.

Here's a look at what's driving the slowdown in Asia's top economies, as well as the countries at risk of recession:

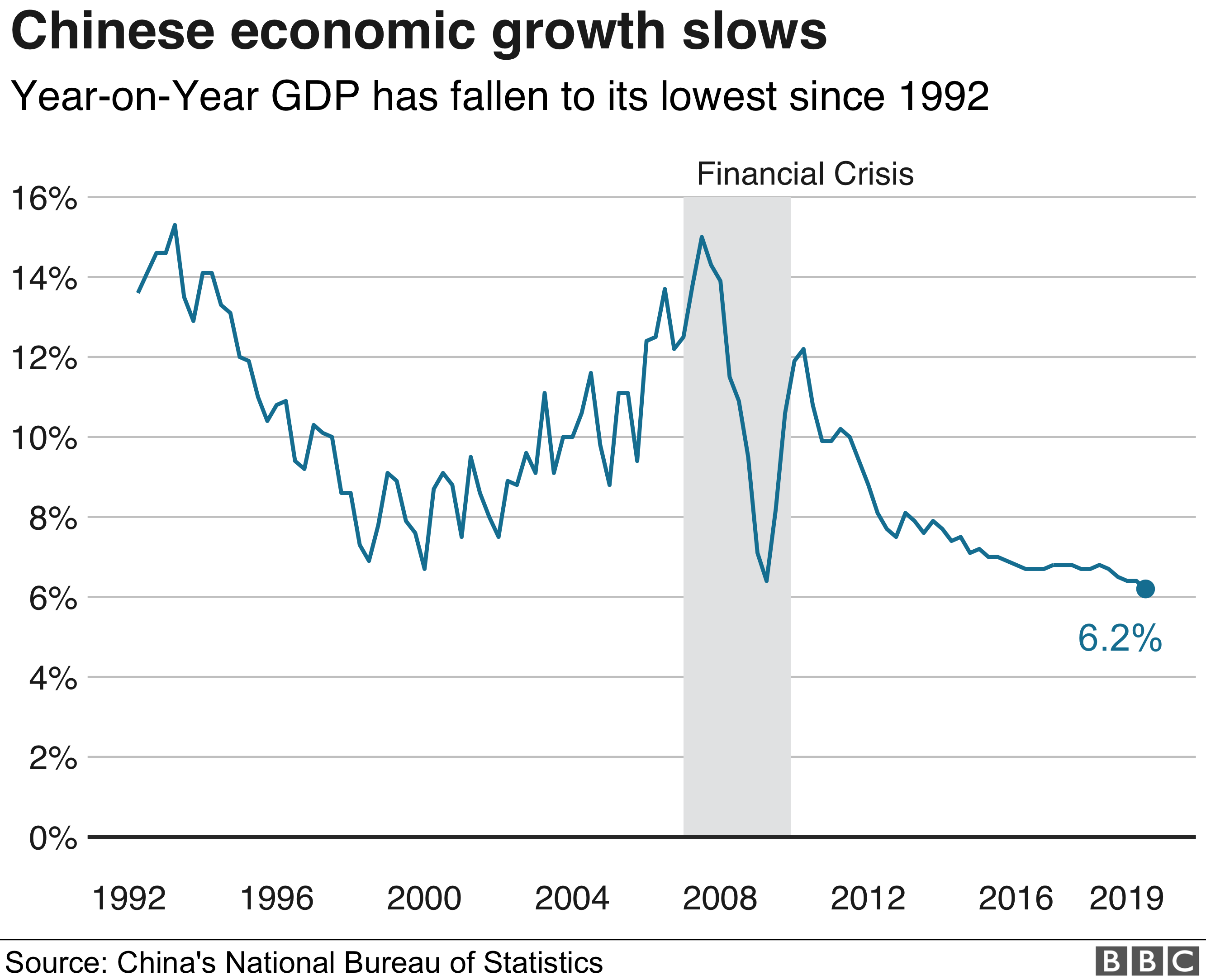

China

Growth in the world's second-largest economy has been for easing for years. The latest figures show China's gross domestic product (GDP) grew 6.2% in the second quarter, its slowest pace since the early 1990s.

The trade war that has seen Washington impose tariffs on billions of dollars' worth of Chinese goods is adding more strain.

It has hurt some Chinese firms, with roughly 20% of the country's exports sent to the US. But perhaps more harmful to businesses is the lack of clarity over when the long-running dispute will end.

"The one thing that is affecting business plans is the uncertainty of the US-China trade war, probably more important than the tariffs," says Mr Kuijs.

"The uncertainty is a major factor of [the concerns] we see globally."

Beijing has taken a series of steps this year to support the economy, including tax cuts and infrastructure spending. For 2019, the government is targeting growth of between 6% and 6.5%.

Japan

Mr Kuijs points out that what happens to China matters a lot to the rest of Asia.

The slowdown there and the trade war have knocked business confidence in Japan, a country also grappling with softer global demand for its exports, such as electronic equipment and car parts.

But its latest economic figures were fairly upbeat. Preliminary data showed GDP increased 0.4% in the second quarter - beating an expected 0.1% rise - thanks to strong consumer spending.

GETTY IMAGES

GETTY IMAGES

Still, the world's third-largest economy faces a threat to spending when a long-awaited sales tax increase is introduced in October.

"Conditions probably won't remain as healthy as they are now, as domestic demand is set to weaken after the tax hike," Capital Economics Japan economist Marcel Thieliant says.

India

Over in Asia's third-largest economy, growth has faltered amid sluggish demand at home and weak investment. India's latest quarterly GDP growth dropped to a five-year low of 5.8%. The next GDP reading, due 30 August, could be weaker still.

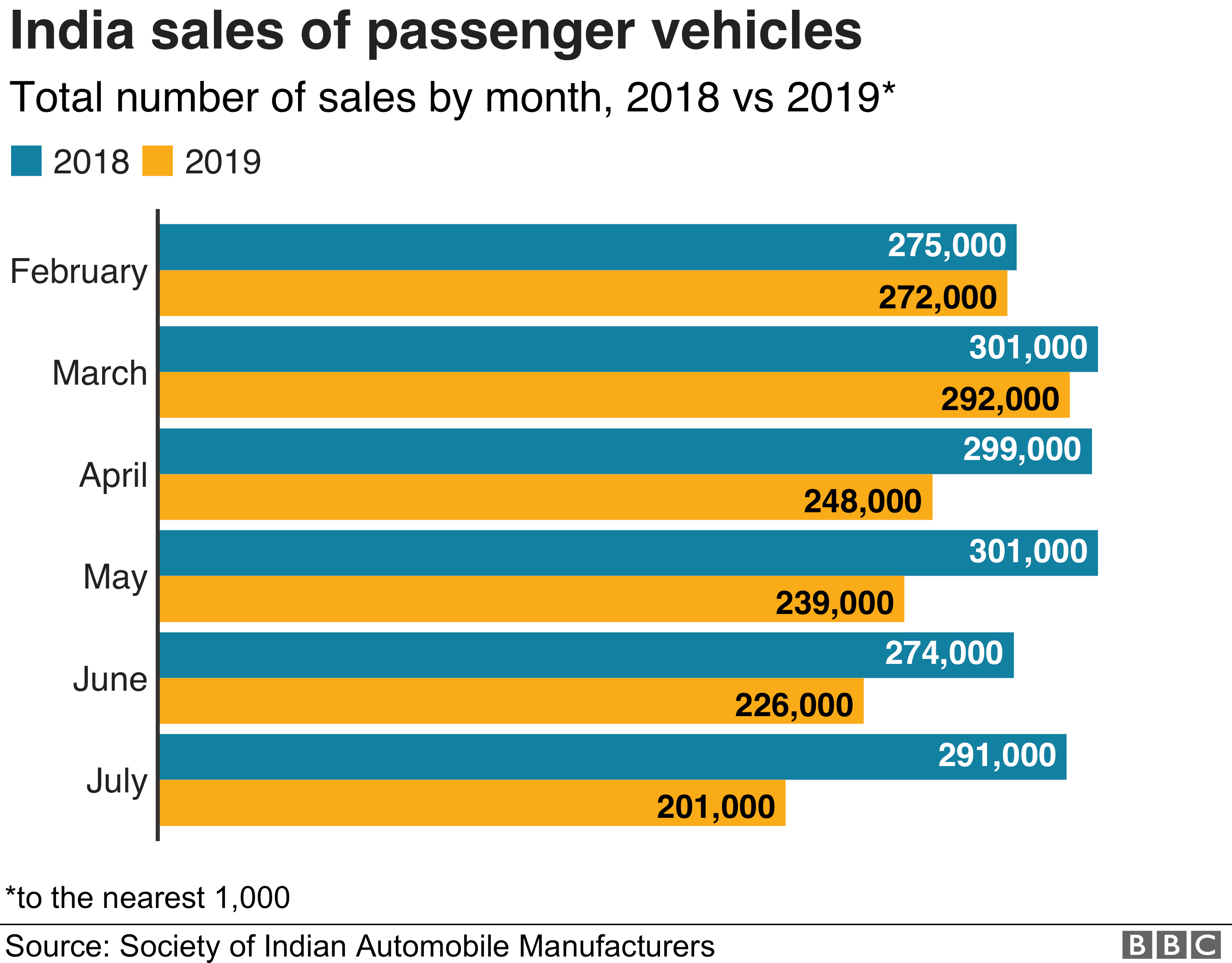

The country has relied on domestic consumption to spur its huge economy, but spending has slowed sharply.

Car sales are one troubling example. In July, passenger vehicle sales plunged 31%, the steepest monthly fall in nearly two decades. The sector has slashed jobs and cut production as sales dry up.

So far this year, India's central bank has cut rates four times. The benchmark rate currently sits at a near-decade low.

More stimulus measures to boost the economy, which is also battling the threat of a widening trade conflict with the US, are expected this year.

Hong Kong

The Asian financial hub is fighting the pressures of a slowdown in China, the trade war and political unrest. Some economists expect that combination to push the territory into recession before long.

Gross domestic product shrank 0.4% in the three months to June compared with the previous quarter.

But those figures did not capture the impact of the pro-democracy protests that have gripped Hong Kong for more than two months, hitting tourism and retail sales.

Economists at DBS and Capital Economics are among those expecting that third-quarter numbers, due out in November, will show Hong Kong has fallen into a technical recession, defined as two consecutive quarters of negative growth.

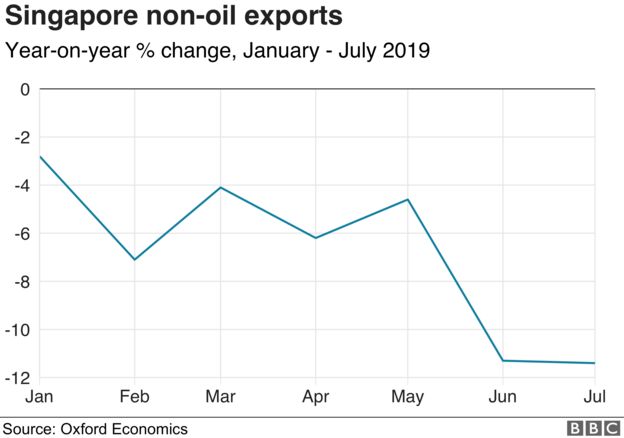

Singapore

The trade-dependent city state has been hit by weak global demand, slowing growth in China and the trade war.

Singapore is reliant on high-tech exports - and softer demand for electronics around the world has darkened its economic outlook.

The economy shrank by 3.3% in the second quarter, on a seasonally adjusted annualised basis. That prompted the government to cut its growth forecasts for 2019 to between 0% and 1%.

Oxford Economics expects that third-quarter GDP numbers, due in October, will show a contraction, meaning that Singapore will enter a technical recession.

Mr Kuijs says the impact of the trade war on Hong Kong and Singapore is "larger than in China itself, even though no one is imposing any tariffs on these countries".

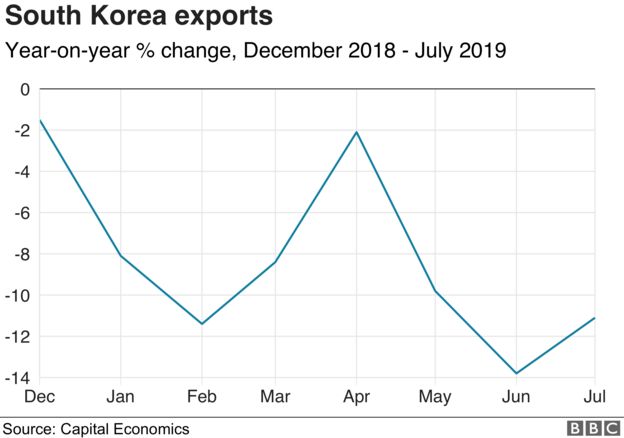

South Korea

Concerns swirled earlier this year that South Korea could slip into recession. But it managed to avoid that outcome after huge government spending helped the economy swing back to growth in the second quarter.

Gross domestic product grew 1.1% in the three months to June compared with the previous quarter, when South Korea posted its sharpest contraction since the global financial crisis. In July, the country's central bank cut rates for the first time in three years.

Much of the pain has been caused by faltering tech exports, driven by the global electronics slowdown. That trade is crucial to South Korea, since electronics account for around 30% of the country's exports. A simmering trade battle with Japan is adding more uncertainty to South Korea's growth prospects.

No comments:

Post a Comment