PA MEDIA

PA MEDIA

The Bank of England has signalled that prolonged Brexit uncertainty will keep interest rates lower for longer.

Policymakers said the UK would avoid falling into recession this year, but warned that Brexit and trade worries were weighing on the economy.

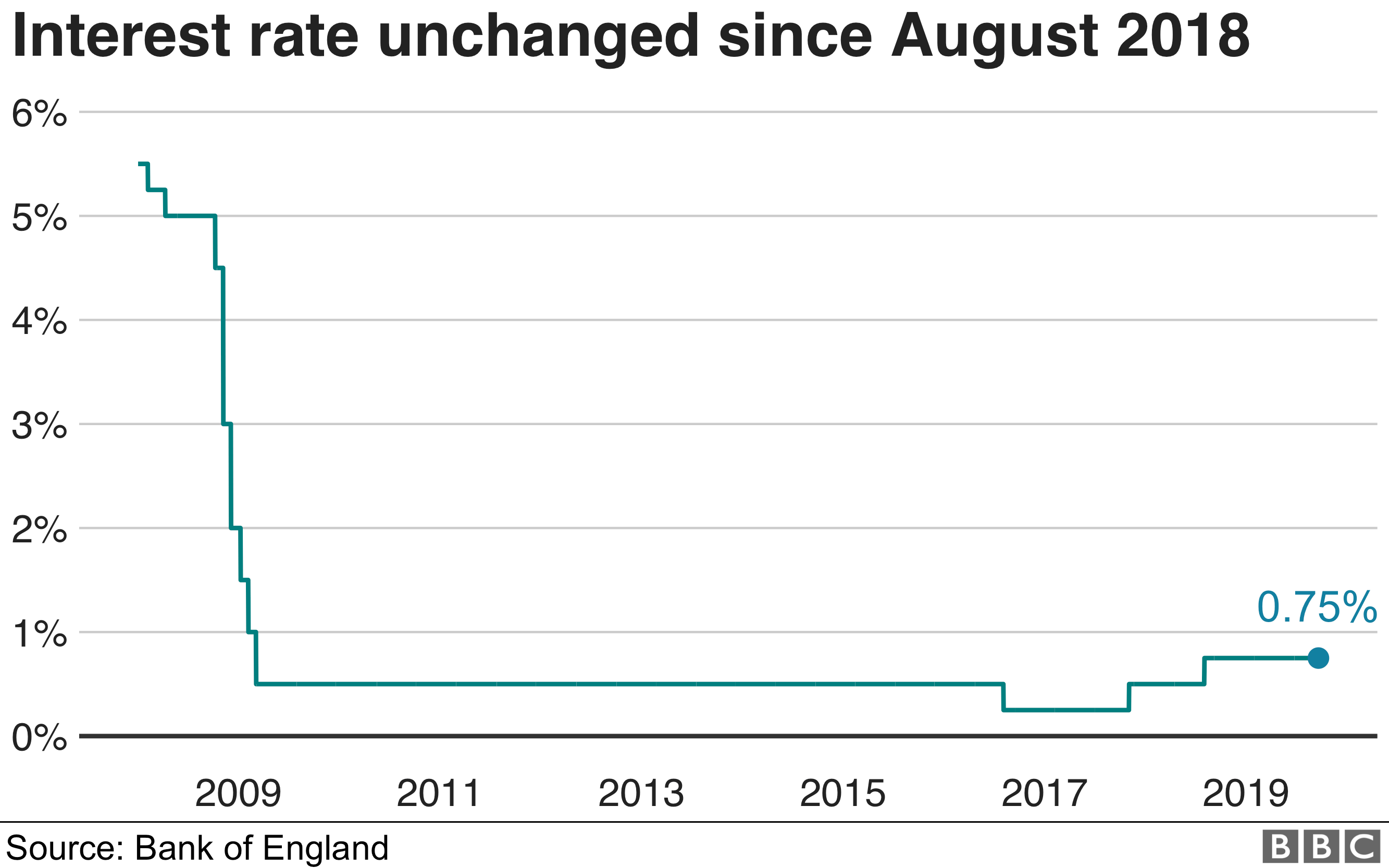

The Bank kept interest rates on hold at 0.75%.

The Monetary Policy Committee (MPC) that sets interest rates also warned that a no-deal Brexit would hit the economy.

Policymakers said it would lead to weaker growth, higher inflation and a further drop in the value of the pound.

However, the Bank stressed that interest rates could move up or down if the UK left the European Union without a deal.

The minutes of the Bank's September meeting said that policymakers would have to balance raising interest rates to keep a lid on inflation against cutting them to support growth.

How does the Bank see the outlook?

The UK economy contracted by 0.2% in the three months to June. The Bank expects the economy to expand by 0.2% in the third quarter of this year.

While this is weaker than the 0.3% growth predicted last month, it means the UK is expected to avoid a technical recession, defined as two consecutive quarters of economic decline.

A survey by the Bank showed that consumer spending remained robust, with many families choosing to spend more time in the UK this summer rather than go abroad because of the weaker pound.

PA MEDIA

PA MEDIA

It said the increase in "staycations" had boosted spending on restaurants and hotel accommodation.

The Bank also said the government's decision to inject more money into departments in the latest Spending Review would boost UK growth by around 0.4% over the next three years.

What about Brexit?

The MPC said that the ongoing uncertainty over the UK's relationship with the EU risked a further period of "entrenched uncertainty".

They said ongoing uncertainty would lead to weaker growth and less inflationary pressure, reducing the Bank's need to raise interest rates.

The minutes of the meeting said: "The longer those uncertainties persisted, particularly in an environment of weaker global growth, the more likely it was that demand growth would remain below potential."

However, policymakers repeated that more clarity that the economy was heading towards a Brexit deal meant that increases in interest rates would be needed over the next three years.

Why does the Bank think rates will stay low for longer?

The Bank of England, like many of us, is on hold, and in a Brexit holding pattern too.

Although there is no change in the Bank of England's interest rate decision, marking out the UK from its counterparts in the US and eurozone, there are interesting Brexit developments in September's deliberations of the Monetary Policy Committee.

For the first time, the Bank has felt the need to signal a direction of travel for interest rates in the now plausible scenario of "political events" leading to "a further period of entrenched uncertainty" about Brexit.

The committee concluded that the longer that uncertainty continues, particularly against a background of a weak global economy, the more likely that growth, and also inflation will slow.

The implication of these minutes being that UK base rates would also remain lower for longer.

It has until now signalled that rates are likely to rise gradually back from its post-crisis lows only if there was a "smooth Brexit", a deal with a transition.

Or else under no-deal, amid exchange rate falls, inflation rises and slower economy, there could be either cuts or rises.

What did the MPC say about the global economy?

Policymakers said the US China trade war had intensified over the summer, which would continue to weigh on overall growth.

Manufacturing output continued to be weak, and while policymakers said the direct economic impact of ongoing trade tensions was likely to be "relatively small", they said the trade war was "having a material negative impact on global business investment growth".

They did not say how the recent attacks on Saudi Arabia's oil supply would affect inflation except to say that prices had risen sharply following the attacks.

No comments:

Post a Comment