GETTY IMAGES

GETTY IMAGES

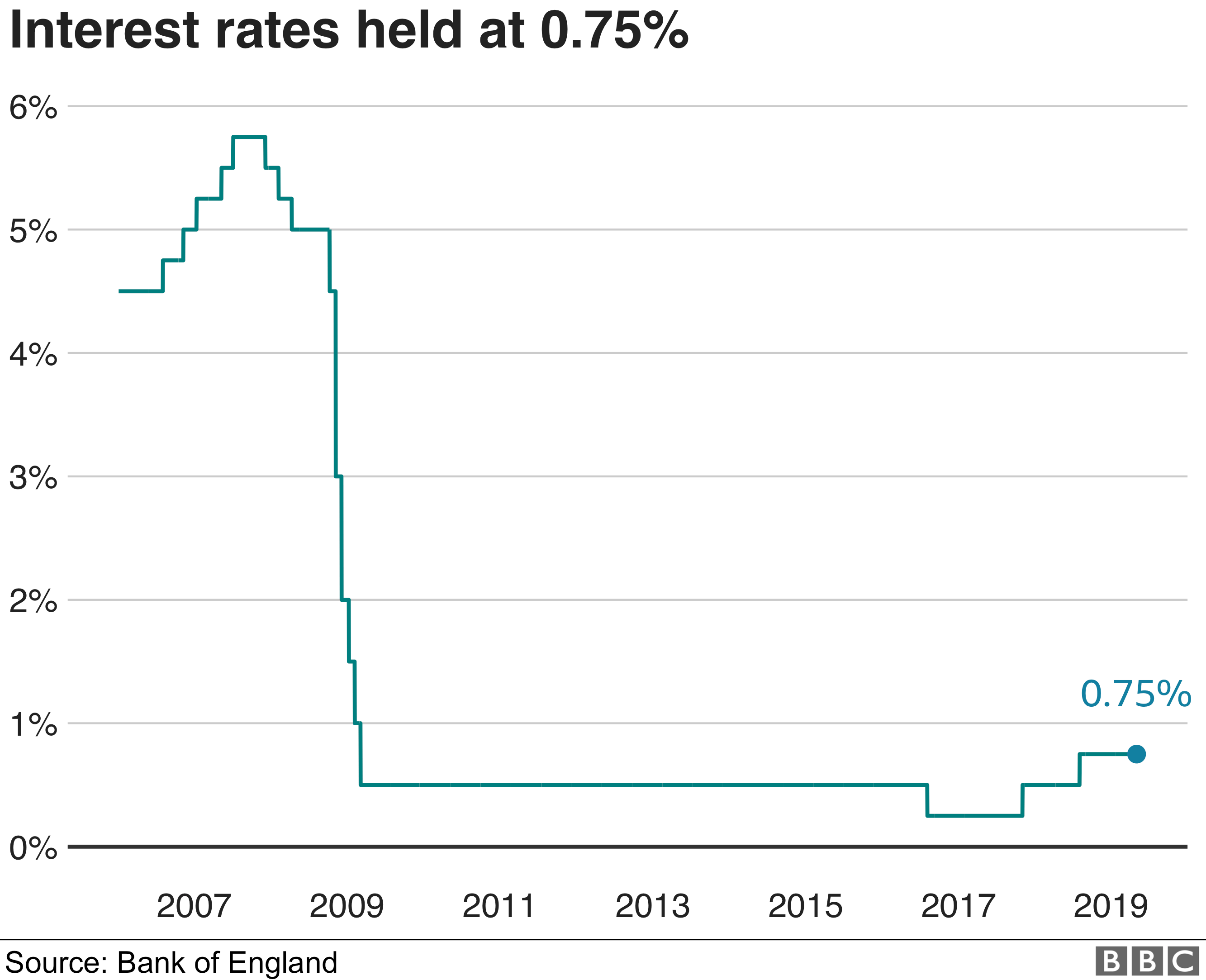

The Bank of England is set to announce whether or not it will change or hold interest rates on Thursday.

The Bank's "base rate" is used by High Street banks and other lenders who set borrowing costs.

Some investors think the first cut to the rate since 2016 could be on the cards, although others say it is too close to call.

The rate, which is currently 0.75%, affects everything from mortgages to business loans and has a big impact on people's and companies' finances.

So why could a cut be coming up? And how could that affect consumers' bank balances?

Why a cut could take place

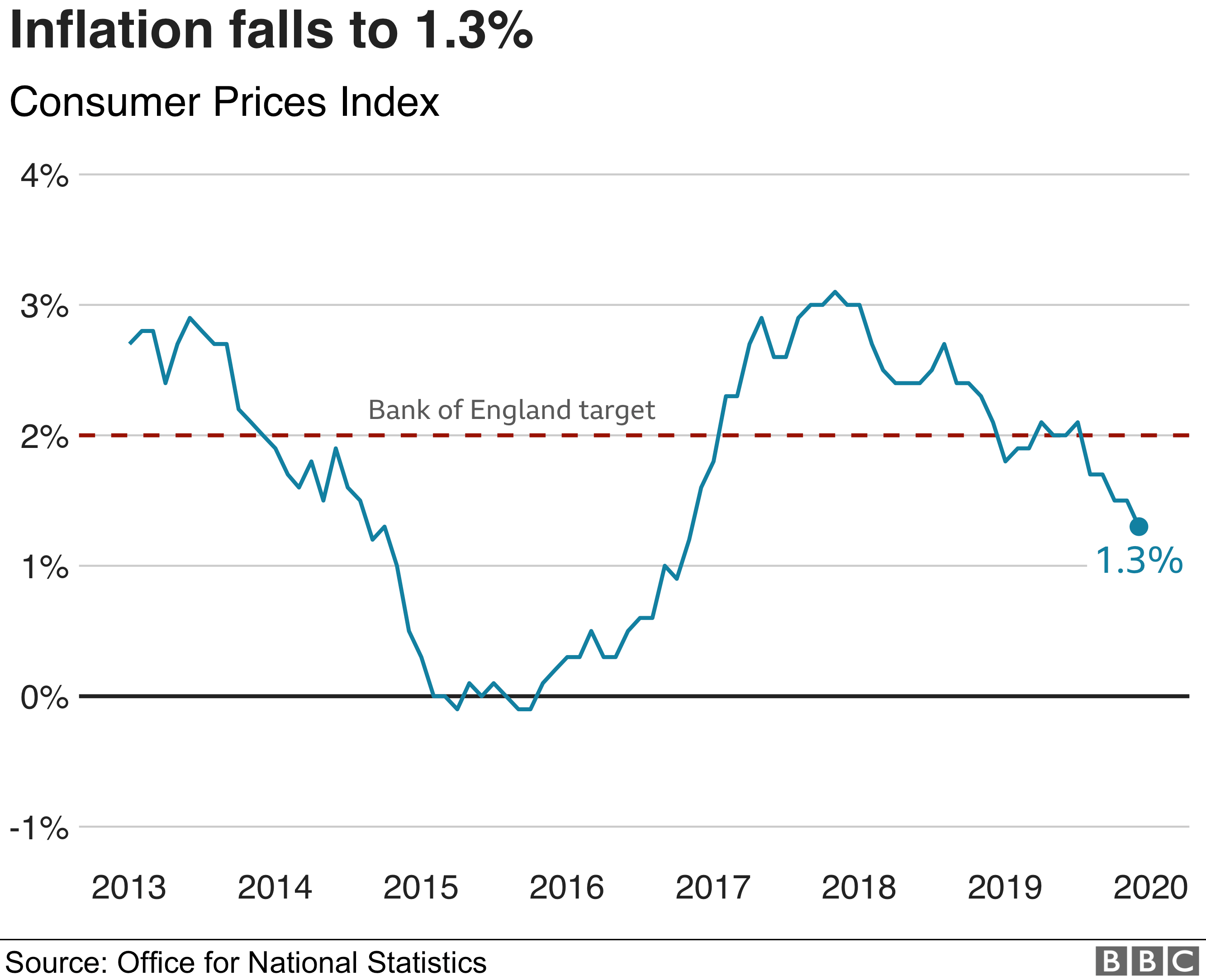

Inflation, the rate at which prices for goods and services increase, is one key factor the Bank of England considers when setting the base rate.

Inflation dropped to 1.3% in December, down from 1.5% in November, partly due to a fall in the price of women's clothing and hotel rooms.

If the Bank thinks inflation is likely to stay below its target of 2%, it may cut interest rates to lower the cost of borrowing and therefore encourage spending.

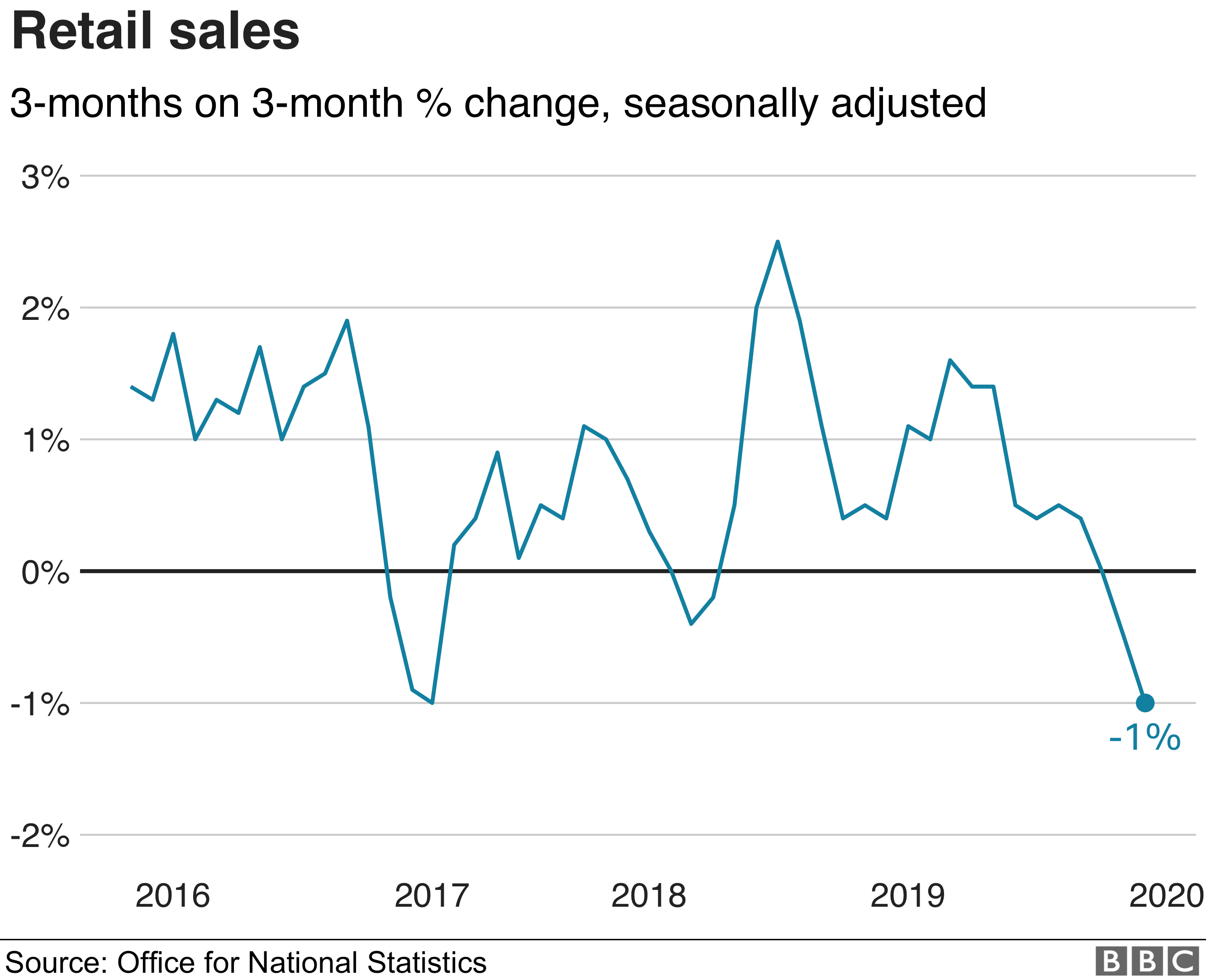

Other recent sets of data might suggest that the UK economy could do with a boost from its central bank.

Retail sales fell in December as Christmas shoppers bought less food and goods in the run-up to the festive period.

In the three months to December, the quantity bought in retail sales fell by 1% when compared with the previous three months.

Overall, the UK economy grew by just 0.1% in the three months to November.

Initial estimates suggest that the economy shrank by 0.3% that month. That was largely down to a decline in both services and production.

Economists at Bank of America expect the Bank of England's Monetary Policy Committee (MPC) to cut the base rate to 0.5% on Thursday.

"We had thought that the MPC might wait until a few months after the general election, or the chancellor's first Budget, to make a decision on interest rates," said Robert Wood, chief UK economist at Bank of America.

"But it seems as though they might want to offer a helping hand to the economy a bit sooner than expected."

Too close to call?

Earlier in January, markets put the likelihood of a rate cut as high as 70% - although this is now back down at about 50%. And even Mr Wood believes Thursday's decision is "finely balanced".

As other figures have noted, there are brighter spots in the UK economy.

For example, the UK employment rate stands at a record high of 76.3%, according to the latest release from the Office for National Statistics.

Some surveys have also shown a more positive outlook for business after voters went to the polls in December.

UK manufacturing and services saw their best month for more than a year in January, according to the composite purchasing managers' index (PMI).

IHS Markit, which compiled the survey, said demand was growing after the election.

James Smith, an economist at ING, said the Bank's decision would be a "close call" and questioned whether businesses would remain optimistic.

"The key conundrum for policymakers is whether or not this [optimism] will last."

He added that the MPC committee, headed up by the outgoing governor Mark Carney, could wait to see "how better survey data translates into real economic activity, before deciding whether to act at future meetings".

"We aren't expecting a rate cut this week," he said.

What would a cut mean for consumers?

Whether the base rate is held or falls, High Street banks often pass on the costs to their customers, by raising or cutting the rates offered on loans or savings accounts.

So a cut to the base rate could make it less rewarding to save.

After the Bank of England last cut interest rates in 2016, the average savings rate for an "easy access" bank account fell by 0.14% in the three months after, according to financial information service Moneyfacts.

Savings accounts rates have been cut by some banks more recently.

Santander announced a cut to the interest paid on balances up to £20,000 in its 123 current account from 1.5% to 1%.

GETTY IMAGES

GETTY IMAGES

However, a rate cut could be good news for borrowers, as the rate of interest they repay is likely to be lower.

Those on a variable-rate mortgage, or a "tracker" mortgage, could see changes in their bills.

But if you're on a fixed-rate mortgage and the Bank of England's base rate is cut, you won't benefit from reduced repayments.

No comments:

Post a Comment