And you think you're having a bad week?

Global gloom is catching up with the U.K. While economic growth came in at 0.5 percent in the fourth quarter, a recent bad run of numbers is threatening that pace. Markit Economics sees 0.3 percent — at best — this quarter, and says its indexes are back at a level that in the past has been consistent with more Bank of England stimulus.

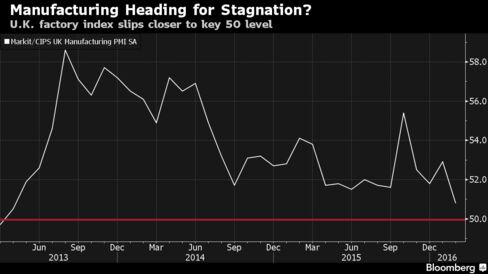

Manufacturing, highly dependent on exports, has been struggling against global headwinds. But services, the biggest part of the economy, was apparently faring well — until this morning.

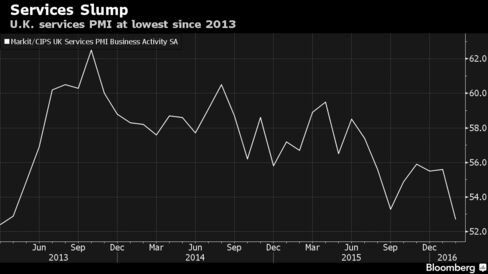

Here's Markit's index of activity in services. Now at the lowest in almost three years.

And here's manufacturing from Tuesday.

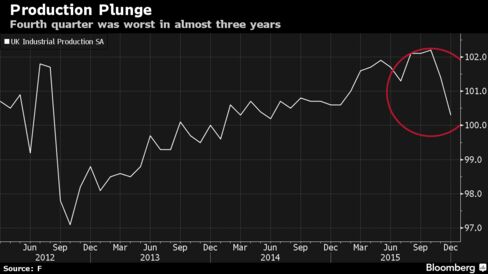

Even going back to last Thursday's fourth-quarter growth data, there are troubling signs. While the pace compared favorably with Europe's other big economies of Germany, France and Italy, the detail showed imbalances. Net trade dragged on growth, as did industrial production, which dropped 0.5 percent in the quarter.

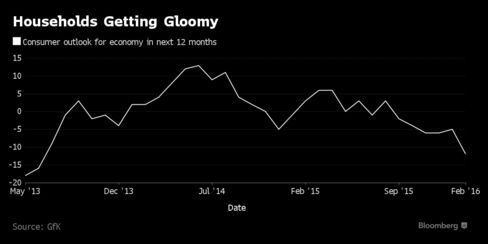

And what about the Brits themselves? Consumers have helped to keep the show on the road, but even they've become a little nervous about the outlook. Here's a measure of their economic optimism from GfK last Friday, and it's near the lowest in three years.

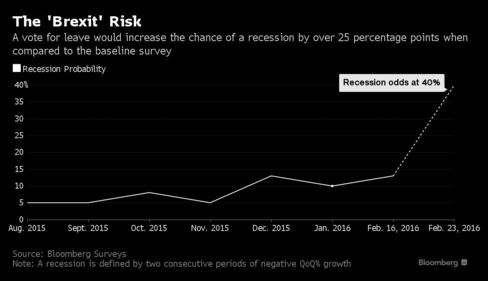

And there's still the vote on EU membership to come. While most polls last month gave the "stay" camp a lead, it's the big cloud hanging over the year. Economists in a Bloomberg survey in February said a vote to leave — a “Brexit” — would dramatically increase the chance of a recession.

They put the odds at 40 percent, three times the risk seen if the status quo is kept.

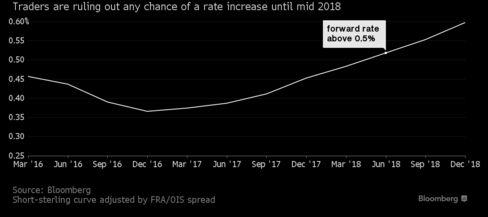

At least the Bank of England isn't making any moves to increase interest rates from a record-low 0.5 percent. Even with unemployment at a decade low and limited spare capacity, global risks have increased and the economy isn't quite on a solid footing. Some investors are even pricing in a rate cut.

No comments:

Post a Comment