Home values in London’s best districts fell for the third consecutive quarter as financial-market turmoil and the risk that the U.K. may vote to leave the European Union damped demand, according to broker Savills Plc.

Properties in neighborhoods defined as prime central London declined 0.8 percent in the first three months of the year, Savills said in a statement on Wednesday. Values probably won’t rise this year, according to Lucian Cook, the broker’s head of residential research.

Home sales, which have slowed since the government increased stamp-duty sales tax for the most expensive properties in 2014, will continue to suffer as potential buyers await the outcome of a referendum in June to determine whether Britain will withdraw from the European Union. Such a move that could cause companies to cut investment and relocate workers from London.

“Unlike other parts of the London housing market, the prime markets remain fairly price sensitive and increasingly dominated by needs-based buyers,” Cook said. “Given historic levels of price growth, the increased tax burden and political uncertainty stemming from the pending mayoral election and EU referendum, our view is that we are unlikely see any price growth over the course of 2016 as the market continues its adjustment.”

Prices in London’s best neighborhoods, including Belgravia, Chelsea, Knightsbridge and Mayfair, have surged 17.6 percent in the last five years and are expected to rise 21.5 percent by the end of 2020, according to Savills. Values have dropped 6.7 percent from the peak in the third quarter of 2014. The government in December of that year changed stamp duty sales tax so it escalates to 12 percent on every pound a buyer spends above 1.5 million pounds.

Prime home prices across all of London were down 0.3 percent in the first quarter, marking a 1.2 percent decline since the 2014 peak.

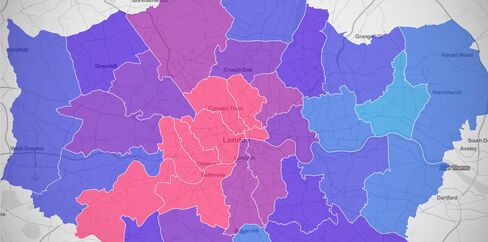

Explore Housing Prices in London

No comments:

Post a Comment