Disappointing economic news has led investors to trim expectations for an interest-rate increase when the Federal Reserve concludes its two-day meeting on Wednesday, though with some officials talking up the need to tighten policy, a hike isn’t out of the question.

The Federal Open Market Committee will issue a statement at 2 p.m. in Washington. Chair Janet Yellen will follow with a press conference at 2:30 p.m. Even if there’s no hike, the statement’s description of the economy, a fresh set of quarterly economic projections and the chair’s press conference could shed light on what the Fed may do next. Here’s what to watch for:

Stay or Go?

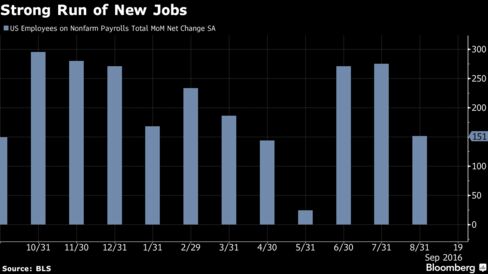

Support for a rate increase gathered this summer as employers added, on average, 232,000 jobs over the past three months, highlighting a split on the FOMC. The camp that favors gradual rate increases includes three officials who vote on policy this year, led by Boston Fed President Eric Rosengren, who is wary of deliberately letting the economy overheat.

Rosengren or Cleveland’s Loretta Mester could potentially join Kansas City Fed chief Esther George in dissenting if the Fed stays on hold. George has already dissented three times this year in favor of higher rates.

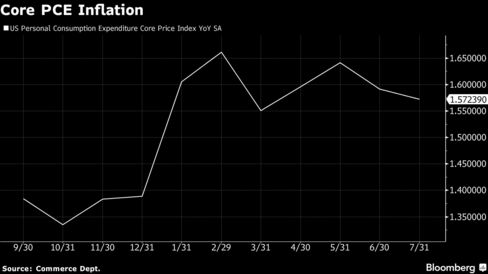

In the opposing camp, Governors Lael Brainard and Daniel Tarullo argued in recent days that the Fed could afford to be patient as it waited for stronger indications that inflation is picking up. The core version of the Fed’s preferred gauge of inflation, which strips out volatile food and energy components, was 1.6 percent in the 12 months through July. It has been below the central bank’s 2 percent target for four years.

Yellen’s last public remarks were Aug. 26 at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming, where she said that the case for raising rates hadstrengthened. That was before August readings for manufacturing, services and retail spending all came in below expectations.

“The incremental news about the economy has been mildly disappointing across a variety of indicators,” said James Sweeney, chief economist at Credit Suisse Securities USA LLC in New York. “If the decision were close, you’d expect this to sway it to no-go.”

In a Bloomberg survey conducted Sept. 12-14, 48 economists assigned an average probability of 15 percent to a rate hike Wednesday, with 5 percent odds assigned to November and 54 percent to December.

A Hawkish Hold?

In the same survey, 65 percent of respondents believed the Fed will “use a stronger form of forward guidance to signal that it intends to hike rates soon” if it leaves rates on hold, a strategy sometimes referred to as a “hawkish hold.”

“This FOMC meeting will be quite contentious,” said Jonathan Wright, an economics professor at Johns Hopkins University in Baltimore and a former Fed economist. “They will try to achieve as much consensus as possible. That means that if they stand pat, as I think most likely, there will be signaling of a likely rate hike later in the year.”

That could include, he said, bringing back an assessment last seen in December that risks in the economy are, or nearly are, balanced, Wright said.

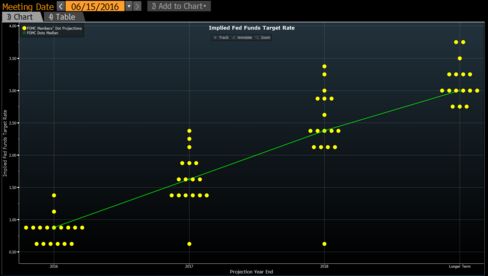

Others think such an explicit signal won’t be necessary. The accompanying quarterly economic projections will already reveal the FOMC’s expectations through the so-called dot-plot, a graphic representation of the FOMC’s forecasts for the appropriate path for interest rates over the next three-plus year. For the end of 2016, it’s highly likely the median projection, as well as a majority of individual projections, will land on 0.625 percent, implying one hike before year’s end.

There’s also a three-month gap before the next FOMC meeting accompanied by a press conference, which can help the Fed manage the impact of an increase.

“I don’t think the Fed will necessarily bring back the balance of risks or insert any other explicit signal in the statement,” said Roberto Perli, a partner at Cornerstone Macro LLC in Washington and former Fed economist. “Risks have still not dissipated entirely, so a firm commitment to move later may be risky.”

Longer Run

Fed watchers will also have an eye out for movement in the dots further out, as well as projections for gross domestic product over the next few years. In June, the median rate forecast implied three hikes in 2017, three more in 2018 and a “longer-run" rate of 3 percent.

FOMC Dot-Plot

The longer-run projection has already declined from 4.25 percent when the dots were introduced in January 2012, reflecting the committee’s “capitulation” to the idea that the neutral rate of interest -- the level that neither stimulates nor holds back the economy -- has fallen, according to Michael Hanson, senior global economist at Bank of America in New York.

Potential explanations for that decline range from population aging, excess flows of global capital into safe assets and declining productivity.

“If the longer-run dots and longer-run GDP forecasts come down, that would be a big acknowledgment on the productivity story,” Hanson said, referring to the new set of forecasts that will be released on Wednesday.

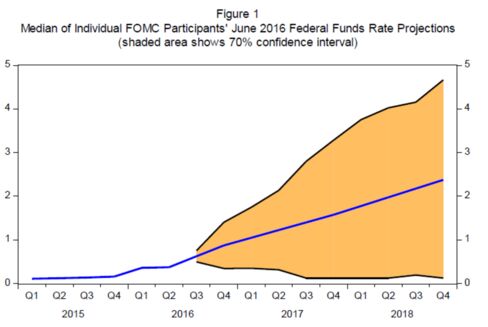

The quarterly forecast might also include something new. In the material released with her Aug. 26 speech, Yellen also published a chart mapping the median of rate forecasts submitted by FOMC participants in June set into a broad shaded area representing a 70 percent confidence band. In other words, to have a 70 percent statistical probability of capturing the actual path of rates through the end of 2018, the shaded area has to include everything from just above zero to about 4.75 percent. The range is based on projections from private and government forecasters over the past 20 years.

The point is to underline how much uncertainty is embedded in Fed forecasts.

Federal Reserve

“The Fed is saying, ‘We could drive a truck through the range of possibilities, but we’re telling you what our best thinking is’,” said Luke Tilley, chief economist at asset manager Wilmington Trust Corp

No comments:

Post a Comment