Ghana’s budget deficit could be twice as big as previously forecast, Finance Minister Ken Ofori-Atta said a day after the government revealed a 7 billion-cedi ($1.6 billion) hole in the budget. The disclosure sent bonds tumbling.

The shortfall as a percentage of gross domestic product could be close to “double digits” for 2016, Ofori-Atta said Wednesday in an interview in Accra, the capital. “We’re still in the process of gathering information” on the undisclosed expenditures, said Ofori-Atta, who will propose the 2017 budget next month.

The secret spending dates back three to four years, he said. The budget hole was disclosed by Vice President Mahamudu Bawumia, who along with President Nana Akufo-Addo arrived in office only three weeks ago after winning presidential and parliamentary elections. It was the third transfer of political power since the West African nation’s return to independence in 1992. The nation is the world’s second-biggest cocoa producer and West Africa’s biggest economy after Nigeria.

“We have been very surprised by the fiscal data,” Bawumia said Tuesday night in a speech in Accra broadcast by Citi FM. “How are you supposed to manage an economy with faulty data?”

The central bank on Jan. 23 urged the state to narrow the budget deficit after provisional data for January through November showed a shortfall of 7 percent of GDP, exceeding a government forecast of 5.3 percent. The West African nation will probably miss its target for 2016 because of weak income collection and higher-than-planned capital spending, the International Monetary Fund said last month.

Read more on Ghana’s IPO and its biggest money manager

The economy probably expanded 4.1 percent in 2016, according to forecasts from the government. It was growing at more than 13 percent in 2011.

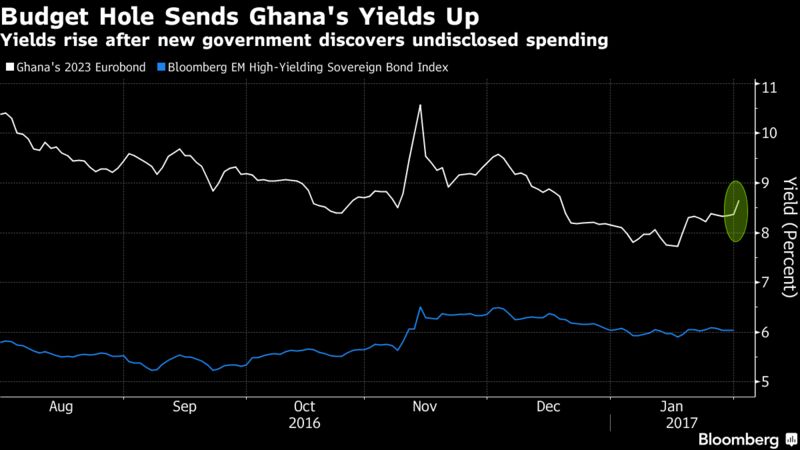

It was another blow to Ghana, only a few years ago held up as an example of how African countries could modernize, impose the rule of law and operate successfully in global markets. In 2007, it sold its first Eurobond. Today, yields on its benchmark dollar bond due in August 2023 increased 17 basis points to 8.58 percent, the highest since Dec. 19, at 3:23 p.m. in Accra. The cedi weakened for a third day against the dollar, slipping as much as 0.4 percent and trading 0.2 percent lower at 4.37.

The country has also muffed the share sale of a state company, which by the time it closed in December was only 85 percent subscribed and had taken three tries. Ghana is in the second year of an almost $1 billion debt bailout deal with the IMF after a slump in commodity prices weighed on income from oil and gold as government debt spiraled. The IMF also suspended aid to Mozambique last year after the southern African country disclosed hidden debt of $1.4 billion.

Debt Fears

The budget deficit for 2017 will be two to three percentage points lower than last year’s figure, Ofori-Atta said.

Investors will be concerned about a wide budget deficit and there’s still the risk of further debt accumulation, said Courage Martey, an economist at Accra-based Databank Group Ltd.,

“There will be a difficulty in payment which can lead to restructuring” of the nation’s debt, he said by phone. “It only shows that our fiscal and debt situation is quite complicated and too complicated to deal with in the short term very quickly, so the Eurobonds will continue to reflect that difficulty in the short term.”

The 7 billion cedis Bawumia referred to relates to a government contract that was part of a project for an integrated financial management system and doesn’t constitute arrears, Former Finance Minister Seth Terkper said by e-mail.

“The vice president is known for rushing with information to the public and the media, particularly with structural measures and reforms without taking time to understand the rational for the reform or the initiatives,” Terkper said.

Calls to the phone of Mustapha Hamid, a spokesman for Akufo-Addo, didn’t go through.

No comments:

Post a Comment