House price growth picked up in February, according to the Office for National Statistics (ONS).

Across the UK, prices rose by 5.8% in the year to February, up from 5.3% in January, it said.

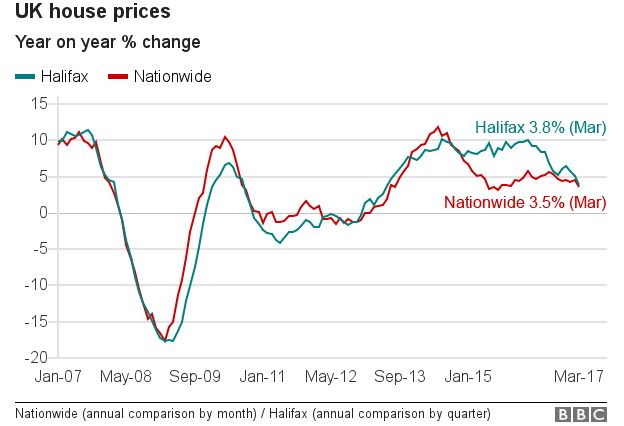

More recent figures from the Nationwide and the Halifax have suggested that house price growth is slowing down.

At the same time, the Council of Mortgage Lenders (CML) reported very strong borrowing in January and February.

The ONS figures - which include cash sales - show that the average price of a property has risen to a record high of £217,502.

Within the English regions, prices are rising fastest in the East - up 10.3% in the last year.

At the other end of the scale, prices are rising by just 2.2% in the North East.

According to the Nationwide, average prices fell during the month of March. And last week the Halifax said annual house price inflation was at its lowest for four years.

The CML said borrowing in January and February was the strongest for 10 years. In all, 93,200 loans were taken out in the first two months of the year, the highest number since the financial crisis.

"Seasonal factors traditionally keep the market quieter in winter months, but 2017 began relatively strong on the house purchase side," said Paul Smee, the CML's director general.

"Borrowers took out more loans to purchase a home in the first two months of 2017 than any year since 2007."

That number was driven by an increase in the number of first-time buyers. However, the number of existing homeowners needing a new mortgage to move house has fallen.

No comments:

Post a Comment