South Africa lost its investment-grade credit rating from S&P Global Ratings for the first time in 17 years in response to a cabinet purge by President Jacob Zuma that’s sparked increasing calls for him to resign. The rand weakened.

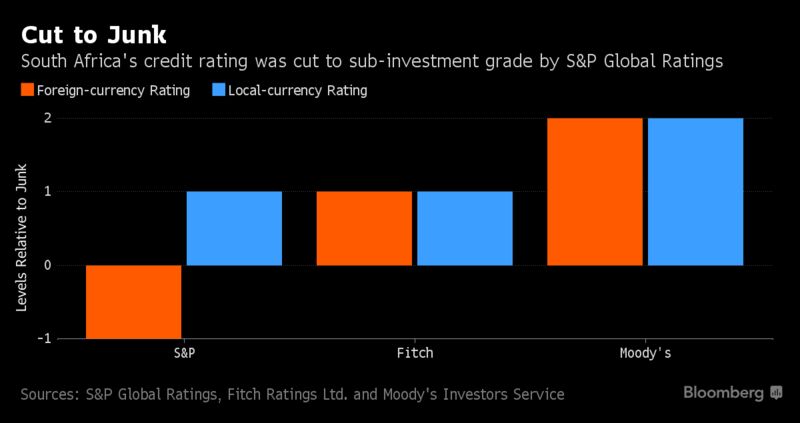

S&P cut the foreign-currency rating to BB+, the highest junk score, on Monday and warned that a deterioration of the nation’s fiscal and macroeconomic performance could lead to further reductions. The local-currency rating was reduced to BBB-, still investment grade, from BBB. The outlook on both ratings was kept at negative, signaling that the next move could be downward. Moody’s Investors Service, which rates the nation at two levels above junk with a negative outlook, said the rating is under review for a downgrade.

Zuma sacked Finance Minister Pravin Gordhan, who pushed for budget restraint, in a stunning cabinet reshuffle last week that’s ignited South Africa’s worst political crisis in almost a decade. Investors regard the firing as a blow to an economy growing at the slowest pace since the 2009 recession and grappling with 27 percent unemployment. The downgrade may further galvanize Zuma’s opponents within the ruling party to push for him to step down after unprecedented criticism from other African National Congress leaders.

“The downgrade reflects our view that the divisions in the ANC-led government that have led to changes in the executive leadership, including the finance minister, have put policy continuity at risk,” S&P said. “This has increased the likelihood that economic growth and fiscal outcomes could suffer.”

Rand Slide

New leadership of the ministry doesn’t mean that government policy will change, the National Treasury said in an emailed statement after the announcement.

“South Africa is committed to a predictable and consistent policy framework, which responds to changing circumstances in a measured and transparent fashion,” it said. “Open debate in a democratic society should not be a cause for concern, but reflects an important means to accommodate differing views.”

The rand slumped to the weakest level since January, declining as much as 2.5 percent, and was at 13.6719 per dollar at 4:55 p.m. in New York. Yields on the country’s dollar bonds due October 2028 jumped 10 basis points to 5.12 percent, a three-month high, while rates on benchmark government rand bonds due December 2026 rose 13 basis points to 9.02 percent.

Investors already demand a bigger premium over Treasuries to hold South African dollar-denominated debt than Russia or Brazil, both junk credits.

The announcement was quick and “more potent, given the timing,” Razia Khan, head of macro research at Standard Chartered Plc in London, said by email. “It substantially raises the risk of ratings action from Moody’s which had assigned a higher rating to South Africa.”

The timing and scope of the reshuffle raises questions over the signal they send regarding the prospects for ongoing reforms, Moody’s said Monday. Recovery is fragile and higher growth in future will be highly dependent on domestic and external investment, according to the rating company, which is scheduled to publish its review on April 7.

Former President Kgalema Motlanthe on Monday urged Zuma to resign, joining calls by the ANC’s ally in government the South African Communist Party.

Zuma doesn’t understand how his actions can influence decisions by rating companies, and his decisions showed a “recklessness” that ruined South Africa’s credibility, Motlanthe said in an interview at Bloomberg’s offices in Johannesburg.

Gordhan, who was replaced by former home affairs minister Malusi Gigaba, was removed after a months-long battle with Zuma over government spending. He’d been trying to ward off a downgrade with plans to narrow the budget shortfall to 2.6 percent of gross domestic product by the fiscal year ending in March 2020, from the current 3.4 percent.

Budget Slippage

“The rating action also reflects our view that contingent liabilities to the state, particularly in the energy sector, are on the rise,” S&P said. “Higher risks of budgetary slippage will also put upward pressure on South Africa’s cost of capital, further dampening already-modest growth.”

Pressure within the ANC has been growing on Zuma to step down after he recalled Gordhan from a trade trip in London March 27 where he was holding meetings with investors and ratings companies. Gigaba, who has no financial or business experience, is the nation’s fourth finance minister in 15 months.

“A downgrade wouldn’t be permanent,” Gigaba told reporters Monday in the capital, Pretoria, before the ratings announcement.

South Africa, the continent’s most-industrialized country, has enjoyed investment-grade standing at Moody’s since 1994, when the ANC came to power under Nelson Mandela. The other two ratings companies upgraded it above junk in 2000.

by

No comments:

Post a Comment