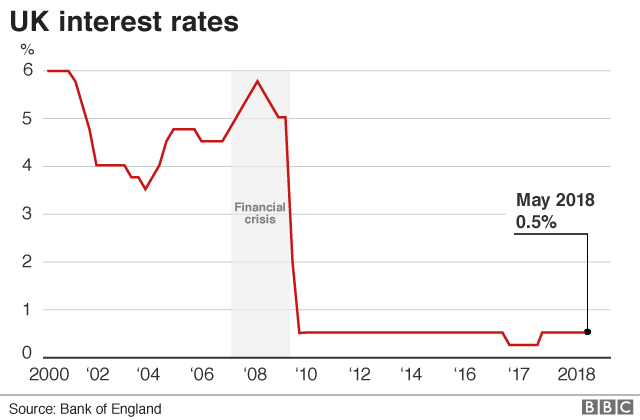

The Bank of England said the UK economy has hit a "temporary soft patch" as it kept interest rates on hold at 0.5%.

The Bank cut its growth forecast for the year to 1.4%, down from the forecast of 1.8% made in February.

The Bank says that cut is almost entirely due to the disruption to the economy caused by bad weather in March.

However, Bank governor Mark Carney said in an interview with BBC economics editor Kamal Ahmed that "it's likely" rates will rise this year.

In a press conference after the rates decision was announced, Mr Carney said the "underlying pace of growth remains more resilient than the headline data suggests".

As recently as February economists were expecting the Bank to raise interest rates this month.

That view changed after figures released last month showed that the economy grew by just 0.1% in the first three months of the year.

The slowdown was caused by the Beast from the East - severe weather which shut down construction sites, kept shoppers at home and caused transport chaos.

However, the Bank described that as a "temporary soft patch" with "few implications" for the outlook for the economy.

The financial markets are now indicating there will be an interest rate increase towards the end of the year followed by another in 2019, and a further one in 2020.

- Live reaction to the Bank's decision

- What would a rate rise mean for me?

- UK economy in weakest growth since 2012

- UK inflation falls to lowest in a year

Movements in the Bank's official rates can have big effects on UK households. A rise would mean that about four million households with variable or tracker rate mortgages would see an increase in their monthly payments, while an increase would benefit the nation's 45 million savers.

Mr Carney sets interest rates with a team of eight other experts that form the Monetary Policy Committee (MPC).

At the latest meeting, seven members voted to keep interest rates on hold and two, Ian McCafferty and Michael Saunders, voted for an increase.

"It looks like the 2018 rate hike has been delayed not cancelled," Fitch Ratings chief economist Brian Coulton said.

However, former MPC member Andrew Sentance said the Bank had "totally misunderstood" the economic slowdown. He said persistent low interest rates and uncertainty over their future direction were undermining the pound and hurting consumers by causing inflation.

Analysis: Kamal Ahmed, BBC economics editor

REUTERS

REUTERS

Is Mr Carney revealing once again his "unreliable boyfriend" tendencies, promising that interest rate rises are just around the corner, only to pull back?

He might suggest that he and the other eight members of the MPC are less the unreliable partners, more the "sensitive" listeners.

Sensitive to changes in the data which effect a decision based on fine margins and delicate judgements.

It was John Maynard Keynes who said that when the facts changed, so, sir, did he.

Today the Bank has changed tone. Let's wait and see, it is saying.

Let's wait and see how the economy develops until we give any firm guidance on the path of interest rates beyond the Bank's often used formulation of some limited rises "over the forecast period" of the next three years.

Yes, they will rise at some point. But the chances of that happening sooner rather than later has receded.

The minutes from the meeting show the MPC wants to wait and see how the economy performs over the coming months.

While they expect it to recover from a weak start to the year, there is a risk that the slowdown could be more persistent.

Rate rise?

The Office for National Statistics appears to be more pessimistic than the Bank of England.

The ONS released data today showing that industrial production expanded just 0.1% in March from February. It said the economy was "sluggish" in the first quarter, but said the bad weather had "little impact overall", suggesting it thinks the economy has underlying problems.

Later on Thursday, in an interview with the BBC's economics editor, Mr Carney said: "It's likely over the course of the next year rates will go up... that's the most likely thing to happen."

But any rate rises would be at a "gentle pace", the governor said. He added that there could be shocks to the UK economy from protectionist trade policies or from Brexit, in which case: "If the economy slows... then we will adjust policy."

The course of interest rates depends on inflation falling in line with the Bank's expectations.

In March, inflation was running at an annual rate of 2.5%, which is above the Bank's target of 2%.

But in its most recent Quarterly Inflation Report, the Bank blames above-target inflation on higher prices of imported goods caused by a weaker pound.

The Bank expects that effect to fade over the coming years, bringing inflation back to 2% by early 2021.

It also forecast that the unemployment rate would fall further, to 4% by 2020, the Bank's lowest forecast since the financial crisis.

No comments:

Post a Comment