The year belonged to people like Bill Heinzelman, a retiree from Wisconsin, and Lucien Durand, a farmer in southeastern France.

They helped propel the populist wave that swept across the western world in 2016, blindsiding pollsters and investors with how strongly they felt the status quo in politics must go. The conventional wisdom among election observers and establishment politicians is that widespread anger at being left behind by globalization compelled Britons to forsake the European Union and Americans to vote for Donald Trump.

Yet the concerns of people from the U.S. Midwest to Greece, where a populist, anti-austerity government has been in power for almost two years, are only partially rooted in a sense of abandonment in a global economy. There’s a deeper discontent with the way they are governed that a fiscal stimulus program, import tariffs or a stock-market rally won’t quickly soothe.

Unemployment where Heinzelman lives is 3.2 percent, matching the lowest level since 2000. His beef is with undocumented immigrants, so the retired small-business owner backed Trump. Durand, whose family farm is in a moderately prosperous region between Lyon and the Alps, said bureaucrats in Brussels who are “totally removed from the real world” have solidified his loyalty to France’s National Front party, which could help propel the anti-euro party under Marine Le Pen to power next spring.

"Whether they’re virtual or real, the reality is we’re going to see a world with more walls," said Ian Bremmer, president of Eurasia Group, a New York-based risk consulting firm.

As a result, it might be years before policy makers absorb the significance of the economic and political forces now playing out, let alone craft a case for globalization that secures broad appeal.

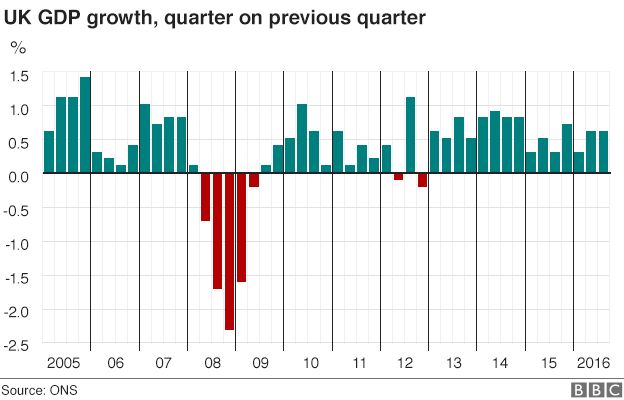

Measures of financial and trade globalization confirm that the integration that has lifted hundreds of millions out of poverty in the developing world is fraying. International bank lending has declined since the financial crisis, data published by the Bank for International Settlements in Basel, Switzerland, show. International bond issuance is stagnant.

And while the amount of trade in goods and commercial services was nearly twice as high in 2015 as in 2005, growth has shuddered to a near-standstill. The ratio of merchandise trade to world output fell sharply in 2015 and is now at roughly the same level as in 2005, World Trade Organization data show.

“Global trade is sliding into ever more gloomy territory,” according to Raoul Leering, head of international trade analysis at ING Bank NV in Amsterdam. Citing the Netherlands Bureau for Economic Policy Analysis, Leering says that global trade in volume terms “took a beating” in October 2016, and is heading for its worst year since 2009.

Journey into America’s manufacturing heartland, and you’ll meet plenty of people blaming their struggles on unfair foreign competition.

"It just sucks. It’s hard to find jobs, and the ones you can find don’t pay enough," said Jeff Mansfield, 39, a Trump supporter in Youngstown, Ohio, who works for a firm selling satellite TV subscriptions. "It’s just living paycheck to paycheck."

Market Optimism

Meanwhile, U.S. financial markets reflect the opposite of glum. The S&P 500 Index has risen more than 10 percent this year. The Bloomberg Dollar Spot Index is reaching new heights. The yield on 10-year Treasuries hit 2.6 percent on Dec. 15, the highest since September 2014, as investors see stronger growth in the world’s largest economy.

To address the malaise of his supporters, Trump is signaling that he’ll keep a campaign promise to turn the U.S.’s economic gaze inward when he takes office in January. On Dec. 21, he named Peter Navarro, a fierce critic of China’s trade practices, as head of a newly created National Trade Council inside the White House.

The real-estate developer’s vow to "Make America Great Again" resonates in places like Youngstown, once a steel-making powerhouse immortalized in a Bruce Springsteen song. With its deep union roots, the town of about 65,000 people used to be considered a Democratic stronghold. But in Youngstown and elsewhere across the so-called Rust Belt, Trump’s message played especially well with white males with no college education, helping to flip counties that went to President Barack Obama four years ago.

Many workers can be forgiven for feeling they aren’t getting ahead. Since 2000, income per capita in the U.S. has risen 2.9 percent to just under $32,000, which works out to an annual raise of less than 0.2 percent.

‘Get Booted’

But it’s a mistake to explain anti-establishment sentiment purely in economic terms. Exit polls show Hillary Clinton beat Trump among those who considered the economy their top issue. Trump was the preferred choice among those concerned about national security and immigration.

For Heinzelman in Wisconsin, undocumented workers are part of the problem and Trump’s tough stance has merit. "When you come into this country and don’t follow the law, you get booted," he said.

In Europe, immigration may be a stronger source of tension than trade. The influx of refugees from war-torn Syria has reignited sensitive debates about identity and culture. U.K. Prime Minister Theresa May plans to trigger EU withdrawal in the first quarter with a focus on gaining control of immigration.

Now, nationalist parties are proving themselves forces in Germany, France and the Netherlands ahead of 2017 elections there that could shape the future of the euro.

"There’s nothing inevitable about globalization," said Jeff Colgan, a political-science professor at Brown University in Providence, Rhode Island. "The cosmopolitan elite of many countries have not done a good job of defending rhetorically the benefits of globalization, and we’re seeing a real challenge to that."

Smith, Ricardo

The openness of world markets has ebbed and flowed throughout modern history. Between the 16th and 18th centuries, European powers sought to hoard as much gold and silver as they could by maximizing exports to other nations. Mercantilism reigned until Adam Smith and David Ricardo explained how trade can make nations collectively better off.

The embrace of that notion in the 19th century helped set off what some call the first age of globalization. Trade boomed amid technological advances such as the steam engine and the monetary stability of the gold standard.

But nations relapsed during the Great Depression, imposing tit-for-tat tariffs and devaluing their currencies. It took the devastation of World War II to convince governments to refrain from protectionism, a commitment that still underpins policy discussions at meetings of the world’s biggest economies.

The risk today is another period of "deglobalization," as Deutsche Bank economists George Saravelos and Robin Winkler warned in a recent report. That could further slow growth in trade, hinder capital flows and erode the "multinational business model" adopted by many corporations, they predict.

Lagarde’s Challenge

Even the International Monetary Fund, seen by some as head cheerleader, has conceded that the system may be tilted too much in favor of those who already wield wealth and power. In an interview this month at Bloomberg headquarters, IMF Managing Director Christine Lagarde said the world needed to "move toward globalization that has a different face, and which is not excluding people along the way."

The defenders of free-flowing capital and labor will be devoting much of next year to figuring out what can be done. The World Economic Forum, which holds its annual meeting in Davos, Switzerland, in January, will

dedicate itself to finding the “agile, inclusive and collaborative responses” needed urgently to address the complexity and uncertainty in people’s lives.

The Group of 20 economies, led by Germany next year, will also be occupied with trying to make globalization benefit everybody. “To benefit from the advantages of global competition and exchange, countries need to enable their citizens to manage the changes in their economic and social life,” Bundesbank President Jens Weidmann said in a speech in Brussels Dec. 19.

Yet if the global elite are focusing their energy on an economics-led band aid, they may find it difficult to apply. About the only thing certain about populist movements is that they run their course -- and not always in a way that leaves their supporters feeling satisfied. The cause -- and source of the remedy -- for populism lies in what Greek political scientist Yannis Stavrakakis calls a “crisis of representation.”

In other words, it’s the gulf between voters and governments that’s what really matters.