Rising fuel and food prices helped to push last month's inflation rate to the highest since September 2013.

The increase has pushed the rate above the Bank of England's 2% target.

Food prices recorded their first annual increase for more than two-and-a-half years, standing 0.3% higher in February than a year earlier.

The Bank of England has said it expects inflation will peak at 2.8% next year, although some economists think the rate could rise above 3%.

Analysis: Jonty Bloom, business correspondent

"DON'T PANIC" are the words that will be written across the Bank of England's next inflation report, in large friendly letters. Well, maybe not, but the Bank's governor, Mark Carney, said pretty much the same when he was quizzed over today's jump in inflation. Actually, what he said was, "Look - single data point, you never overreact to a single data point," but then he is a central banker and not the author of the Hitchhiker's Guide to the Galaxy.

It does, however, amount to much the same thing. The Bank of England is not going to be panicked into increasing interest rates to try to control price rises just because of one month's figures. But that doesn't mean they aren't important.

They show fuel and food prices are rising, a situation not helped by the fall in the value of the pound, which makes imports more expensive. Prices at the factory gate are also rising quickly, suggesting more inflation is on the way to the High Street. And at 2.3%, inflation is increasing at the same rate as average earnings, meaning the average pay rise is being totally eaten up by increasing prices, not likely to make any of us feel better off.

The Brexit vote last June prompted a steep fall in the value of the pound, making imported goods more expensive.

Ben Brettell, senior economist at Hargreaves Lansdown, said the fall in the pound against the dollar had been pushing transport costs higher since last summer.

"Oil is priced in dollars, and sterling has fallen around 13%... since last June's referendum."

He said that transport costs accounted for more than a third of the inflation figure.

Consumer squeeze?

This month, the ONS has started to promote its preferred

inflation statistic, CPIH, which includes a measure of housing costs and council tax. This was also measured as growing at a rate of 2.3% in February.

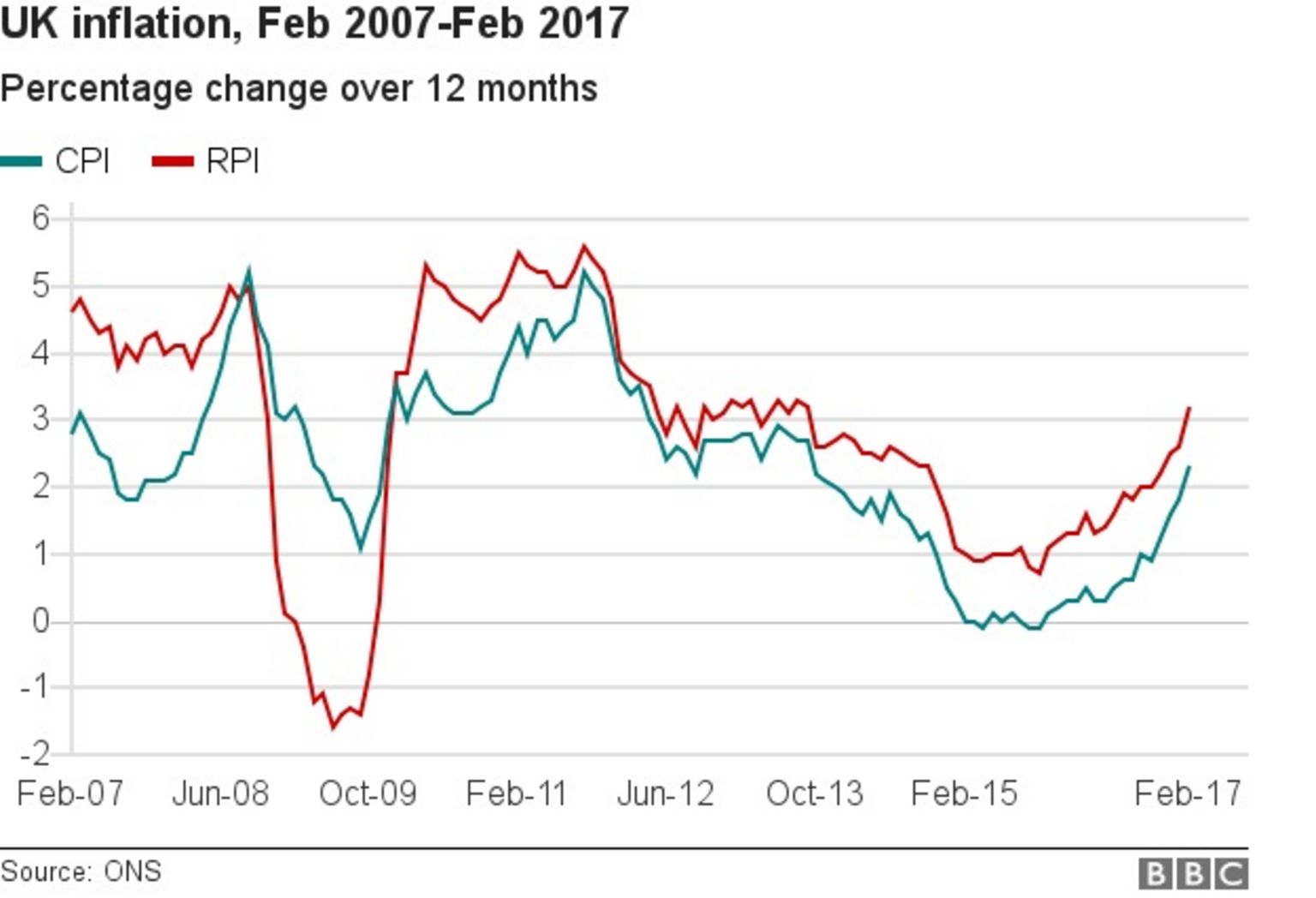

The Retail Prices Index (RPI) measure of inflation rose to 3.2% in February from 2.6% the month before.

At the last week's meeting of the Bank of England's interest rate setting committee, one member voted for interest rates to rise to curb the threat of inflation.

But despite inflation standing above the 2% target, some economists do not expect interest rates to rise any time soon.

Inflation is now running at the same rate as growth in wages, putting pressure on household income and spending.

Chris Williamson, chief business economist at Markit, said: "It remains likely that policymakers will adopt an increasingly dovish tone in coming months, despite the rise in inflation, as the economy slows due to consumers being squeezed by low pay and rising prices."

Analysis: Kevin Peachey, personal finance reporter

The latest inflation figures show that the squeeze on savers just got a little tighter.

Returns are creeping up - but only one of 793 openly available savings accounts matches or beats inflation, according to financial information service Moneyfacts.

That one requires savings to be locked in for some time.

The government's help for savers is a "market-leading" bond, available from NS&I from April. Even that three-year deal is now outstripped by inflation and the picture could worsen if the inflation rate keeps rising.

Wages had grown faster than prices for a while. For those who put some of that money aside, the reward may now not match the endeavour.

The claim:

The claim: