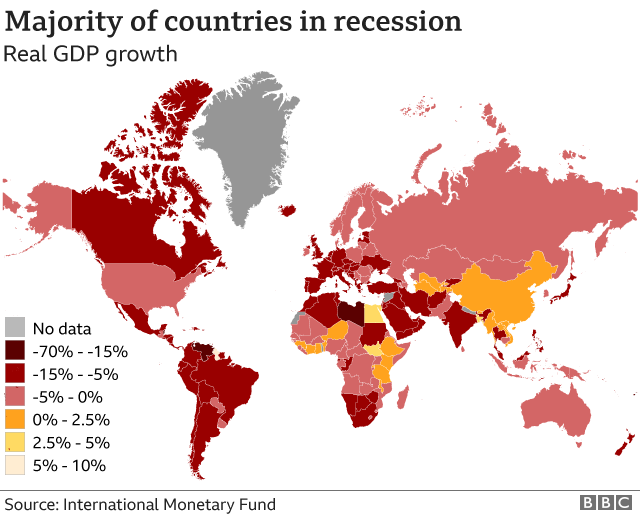

The US economy shrank by 3.5% last year faring better than many other countries despite the heavy economic toll caused by the pandemic.

However growth slowed in the last three months of the year, as a resurgence of virus cases prompted a fresh pullback in activity.

Output increased at an annual rate of 4% in the last three months of 2020.

That was slower than many analysts had expected - and down sharply from the rebound seen in the prior quarter.

The overall fall in 2020 reported by the US Commerce Department was the sharpest decline since 1946, when the US was demobilising after World War II. Compared to the fourth quarter of 2019, output was down 2.5%.

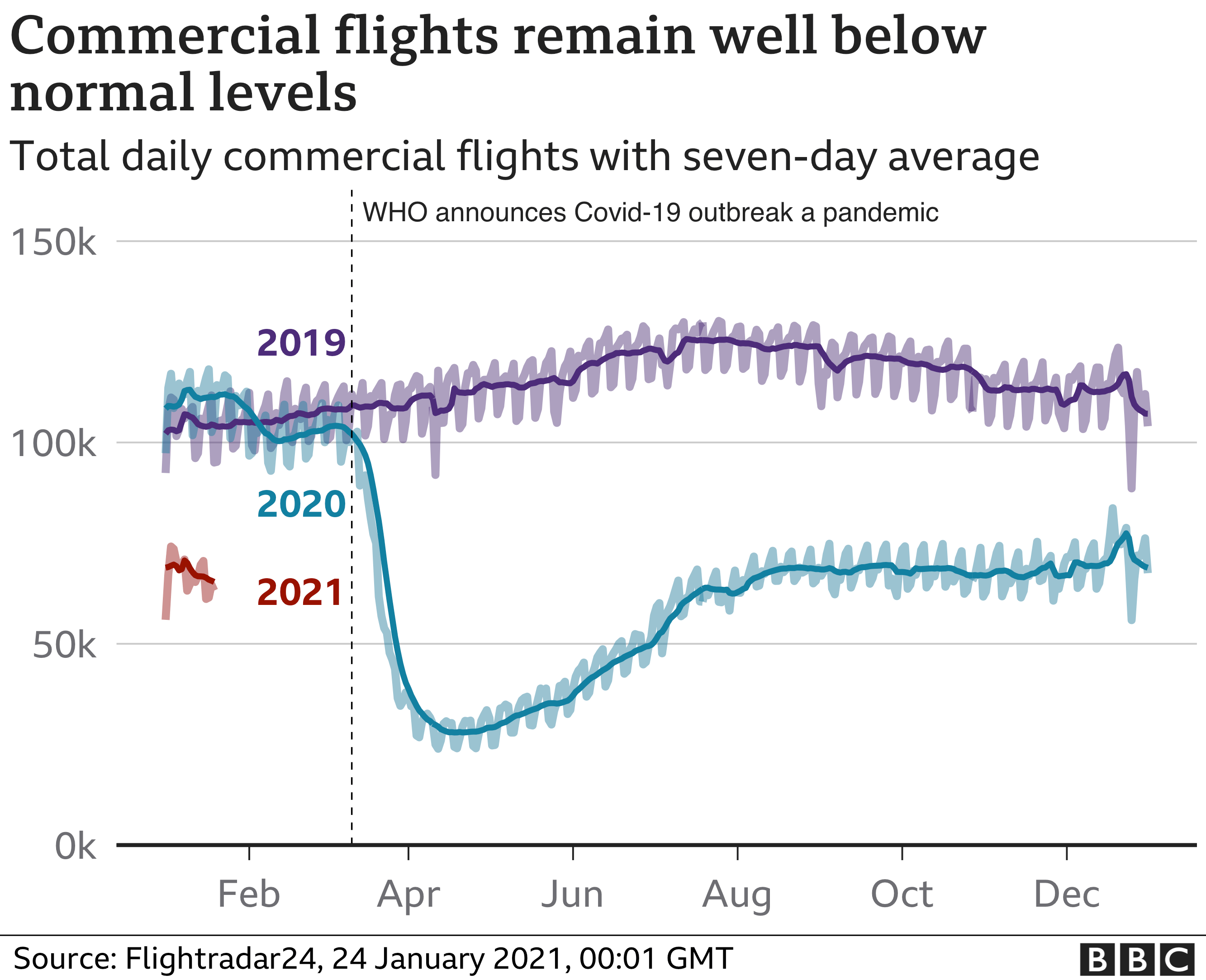

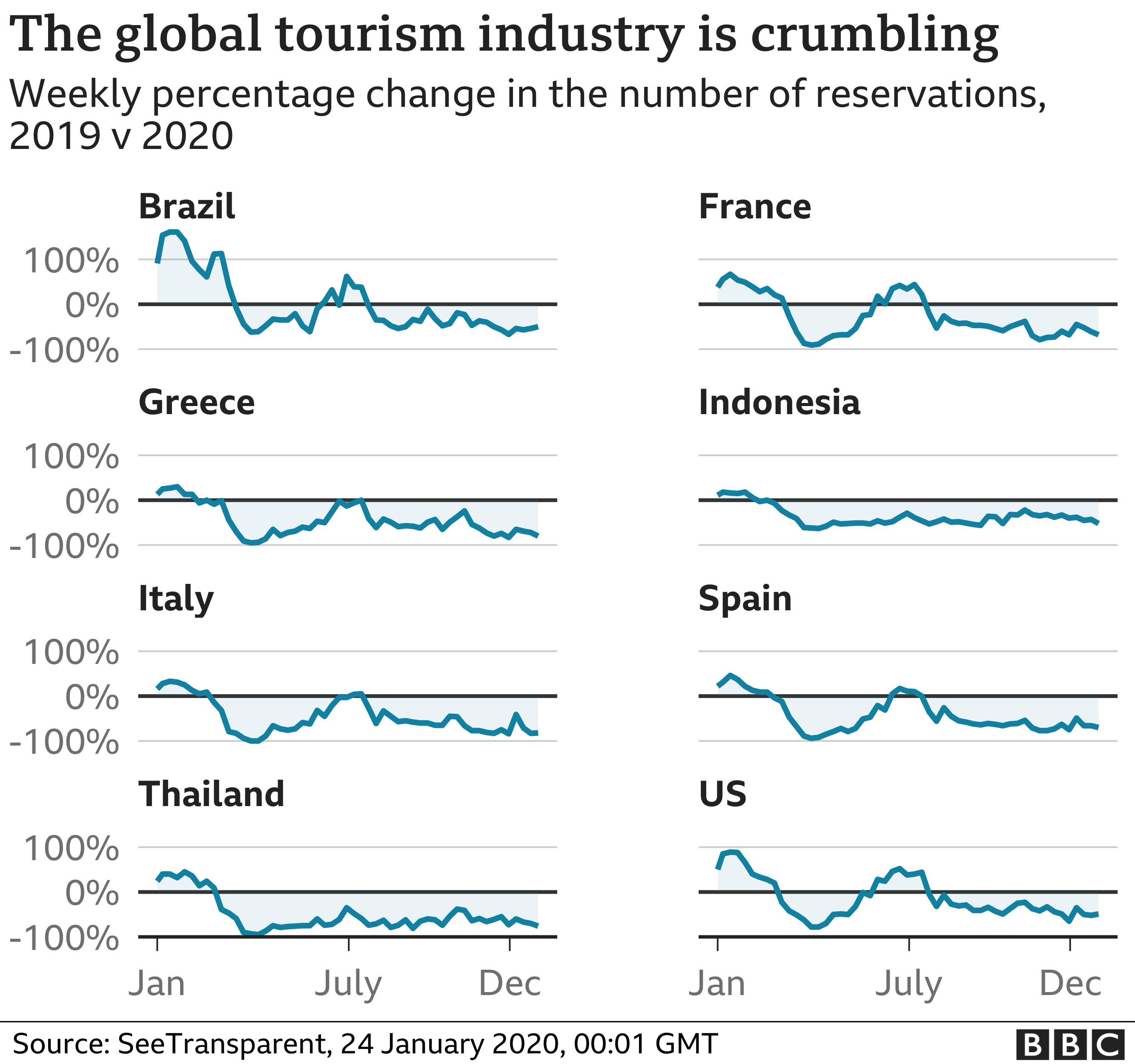

But the contraction was not as bad as many had feared in the depths of the lockdowns last spring, when spending on activity like dining and travel plummeted.

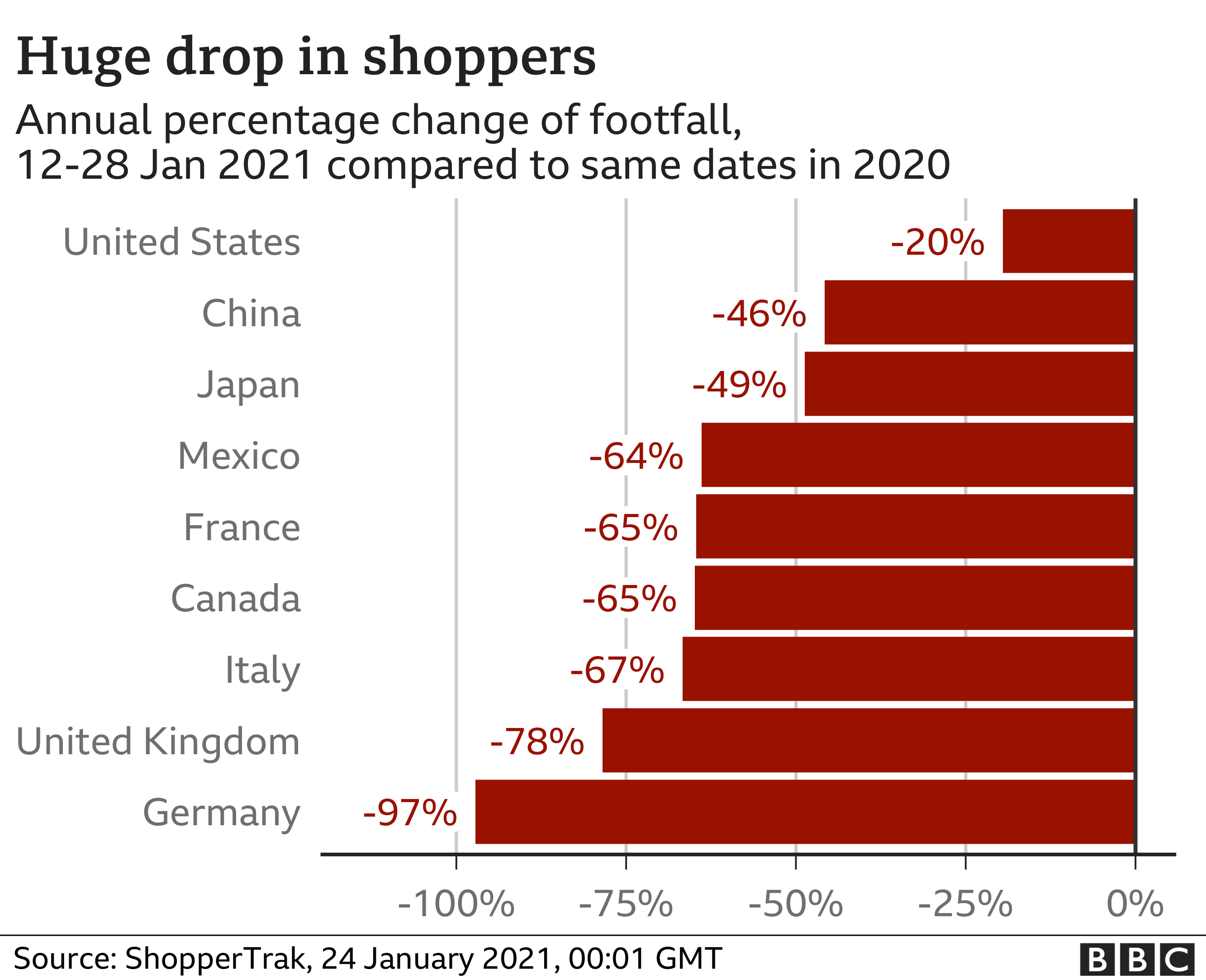

And despite soaring unemployment numbers and a sharp increase in poverty, the US was not hit as badly as many other parts of the world.

The International Monetary Fund estimates that the UK economy, for example, shrank by 10% last year, while Canada, Japan and Germany all dropped by more than 5%.

China is the only major economy that has reported growth, with gross domestic product (GDP) up 2.3%.

US economic growth "was still down by 2.5% on a year earlier, but that still represents a much faster recovery than we would initially have expected given how grim things looked in mid-2020," said Paul Ashworth, chief US economist at Capital Economics.

"With effective vaccines offering the possibility of a return to normalcy later this year and the Biden administration intent on more fiscal stimulus, we think GDP growth will be as high as 6.5% this year."

Stimulus effect

Federal Reserve Chair Jerome Powell on Wednesday credited the rescue packages with helping to ease the crisis so far.

But he warned that the economic rebound was still vulnerable to problems with vaccination rollout and the emergence of new strains.

The US economy grew just 1% in the last three months of the year, compared to the prior quarter, as surging virus cases led to a sharp pullback in consumer spending on dining and other activities.

Some of the shifts produced by the pandemic, such as increased automation and remote work, also mean that some of the jobs that have disappeared may never return, Mr Powell added.

"We're a long way from a full economic recovery," he said at a press conference after the Federal Reserve's regular meeting. "Getting the pandemic under control - that's the single most important economic growth policy that we can have."

Unemployment

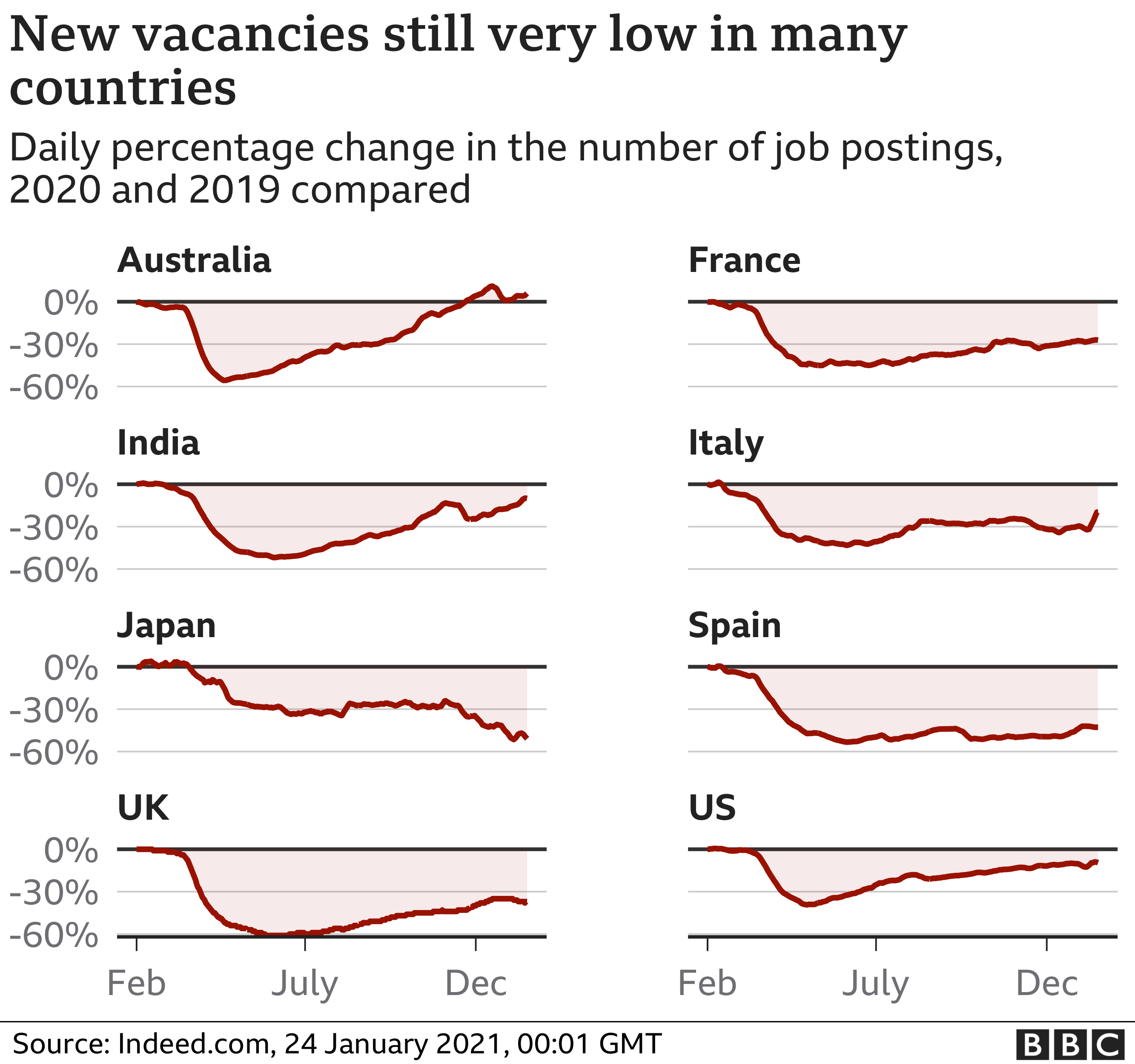

On Thursday, the US Labor Department reported that another 847,000 people had filed new claims for jobless benefits last week - down slightly from a week earlier but still above pre-pandemic records.

More than 18.2 million people were collecting some form of unemployment support in the week ended 9 Jan, it said.

Tim Quinlan, economist at Wells Fargo, said the figures were a sign of the "dark winter" that many officials had warned about.

"We do not look for the labour market to improve meaningfully until vaccine distribution ramps up in earnest and until the spread of the virus is sharply curtailed," he said. "The timing of that remains frustratingly uncertain."

Joe Biden has proposed another $1.9tn in spending, with millions devoted to vaccination efforts, as well as re-opening schools and supporting those cast out of work due to the virus.

But the plan - described as a "bridge" to help the US economy until life can return to normal - will have to overcome resistance in Congress, where many Republicans have said they are sceptical of the need for such programmes and worried about the cost.