As the emerging-market carry trade roars back, there’s a growing consensus that the euro is the best currency to fund it.

Of 21 potential developing-nation carry trades funded in the common currency tracked by Bloomberg 18 of them made money so far this year, given returns of about 8 percent in the ruble. Implied volatility in developing-nation currencies has also dropped to a 10-month low as major central banks including the Federal Reserve turn dovish and amid optimism over a progress in the U.S.-China trade talks, making the strategy attractive.

The euro is giving investors seeking to exploit differences in global borrowing costs more bang for the buck this year as the region’s deep slowdown leave little room for the European Central Bank to tighten any time soon, Bank of America Merrill Lynch, DBS Group Holdings Ltd. and Bank of Singapore Ltd. say. Market sentiment on the currency is also being affected by threats of the U.S. auto tariffs and a “no-deal” Brexit, helping build the case to buy those of nations with higher interest rates, they said.

“Using the euro as a funding currency and being long EM is not a bad strategy because it helps to circumvent or take out some of the trade-war risk on carry trade,” said Claudio Piron, co-head of Asian currency and rates strategy in Singapore at Bank of America. “Given the downward momentum of the euro zone’s economy and negative rates then it seems like it also reinforces the strategy.”

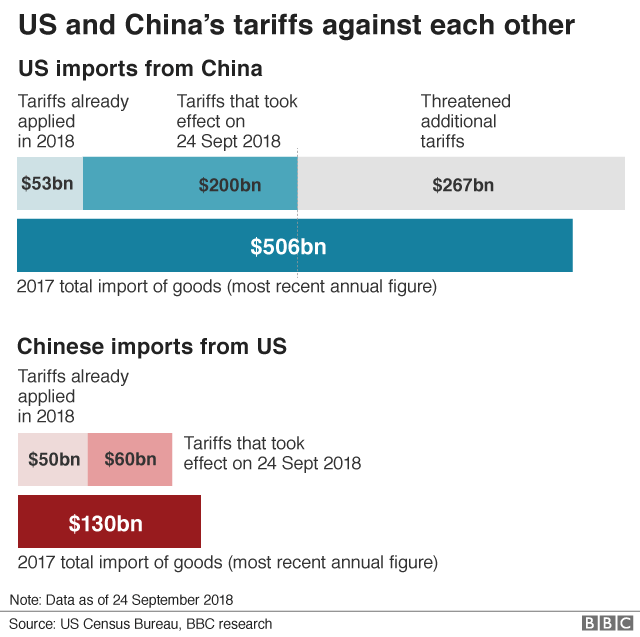

Hedging Trade War

Trades using the common currency have raced ahead as Germany releaseddata in mid-January showing it ended 2018 with the weakest growth since 2013, while ECB President Mario Draghi said later that month the euro zone’s risks had moved to the downside.

The attraction of using the euro is that the currency tends to decline when trade tensions between the U.S. and China escalate because Germany, Europe’s biggest economy, has a high export content to China, said Piron.

The euro’s three-month deposit rate of minus 0.36 percent compares with 2.63 percent for the dollar, meaning the shared currency would need to strengthen about 3 percent to wipe out the benefits of using it for funding. The euro is forecast to rise to 1.16 per dollar by the end-June from the current spot rate of 1.14, according to the median estimate in a Bloomberg survey of 59 analysts done in February and January.

Exploiting Weaker Growth

“The euro has performed well in a carry trade, but it has a lot to do with the weak European numbers at a time when the market is hoping for an easing in trade tensions, and of course, the Fed becoming more friendly in terms of its rate-hike expectations,” said Philip Wee, a senior currency economist at DBS in Singapore. “I see this more as tactical.”

For BNP Paribas Asset Management, a large part of the gains from carry trades is “now at least behind” for the short term as interest-rate expectations have also moderated in various developing economies, lowering the carry potential, Karan Talwar, senior investment specialist in Hong Kong, said in an emailed reply.

Even so, the recent decline in volatility of developing-nation currencies has been a tailwind to the strategy. In a carry trade, currency market moves can erase those profits from investing in a country with higher interest rates with funds in a country with low borrowing costs.

Those funded by the dollar have returned 2.4 percent this year against a basket of 10 emerging-market currencies including the Brazilian real, Turkish lira, South African rand, Indonesian rupiah and the Russian ruble, according to data compiled by Bloomberg. And trades using the euro have gained even more at 3.7 percent.

The euro is a “good idea” as a carry source because its yield is much lower than the dollar and is unlikely to rally sharply unless there’s a complete change in the Brexit situation, said Rajeev De Mello, chief investment officer at Bank of Singapore. “I’m positive of the higher yielding currencies in Asia: the rupiah. All the higher yielders should do well in this time of stability of the U.S. rates.”