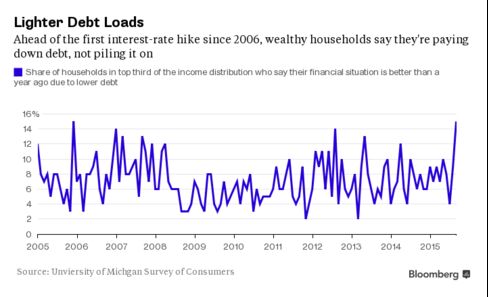

More wealthy Americans now say they're reducing debt than at any time in the past decade, and the Federal Reserve may be to thank.

About 15 percent of high-income households, those in the top third of the earnings ladder, reported debt declined in September, more than any other time since 2005, according to Friday's consumer-sentiment report from the University of Michigan. The share was only one percentage point lower a 35-year peak reached in April 2000. Those same households reported making further progress on their finances, while the bottom two-thirds of the income distribution said their balance sheets worsened.

"The prospects of rising interest rates didn't cause high-income families to borrow in advance of those hikes—it caused them to pay down their debt," Richard Curtin, director of the Michigan Survey of Consumers, said on a Bloomberg conference call after the report. "It could be that the dodging of the hike this month meant more consumers actually looked at their finances more critically.''

Fed policy makers delayed raising the benchmark interest rate at their meeting this month as market turmoil and international-growth concerns threaten to derail the U.S. economy and slow inflation even further. Still, Fed Chair Janet Yellen said Thursday that she and others on the Federal Open Market Committee are ready to raise interest rates this year.

A late-month confidence boost among wealthier Americans in September kept the broader sentiment gauge from falling as much as forecast. Michigan's final reading for the month showed its confidence gauge decreased to 87.2, the lowest level since October, from 91.9 in August. The median projection in a Bloomberg survey called for a reading of 86.5.

No comments:

Post a Comment