Buy-to-let landlords are rushing to purchase U.K. homes ahead of an increase in the stamp-duty sales tax in April.

The number of homes acquired by rental homeowners rose 71 percent in January from the same month a year earlier, according to data compiled by Countrywide Plc. the U.K.’s largest realtor. Landlords purchased 21 percent of all the homes sold in the period, compared with 17 percent a year earlier, Countrywide said.

Chancellor of the Exchequer George Osborne is raising the sales tax by three percentage points for landlords and purchasers of second homes in April, saying they may be pricing first-time buyers out of homes. The Bank of England has raised concerns that the mortgages may pose risks to financial stability because its unclear how landlords will behave if prices fall or costs of repayment increase, Deputy Governor Jon Cunliffe said Feb. 9.

“The jump in activity comes despite many landlords being concerned by the current focus of government on home ownership” at the expense of rental homes, said Johnny Morris, research director at Countrywide. “The reduction in mortgage-interest rate relief due to start in 2017 and prospects of future regulation has left many landlords considering their position, meaning we’ll likely see a drop in investor activity after April.”

Loans to buy-to-let landlords rose 41 percent by value from a year earlier, according todata compiled by the Council of Mortgage Lenders. That compares with a 14 percent increase in lending to first-time buyers in the same period.

Properties purchased as second homes rose to 4 percent of the total for the period, from 2 percent a year earlier, according to Countrywide.

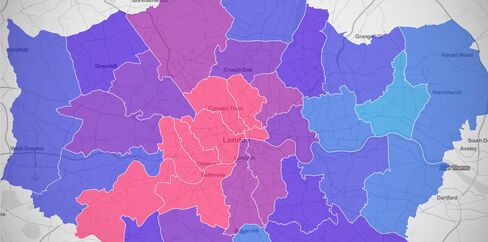

Explore Housing Prices in London

In the private sector, the average London household paid 298 pounds ($427) a week in rent, a 17-pound increase from a year earlier, according to the 2014-2015 English Housing Survey. Rents nationally remained unchanged, according to the report published Thursday.

No comments:

Post a Comment