A credit-rating agency called Dominion Bond Rating Service is scheduled to complete its review of Portugal’s financial fitness on Friday. Moody’s, Standard & Poor’s and Fitch all view Portugal as undeserving of investment-grade status; put another way, Portugal is deemed a risky, junk-rated borrower. DBRS, though, has maintained its country classification at investment grade.

So long as at least one of the four rating agencies judges Portugal to be worthy, its government debt remains eligible to participate in the ECB's bond-buying program. But if the country drops to sub-investment grade at all four, the ECB’s own rules forbid it from buying any more Portuguese government securities -- purchases which have ballooned to almost 15 billion euros ($17 billion) in the program's one-year lifetime.

So if DBRS lowers the nation’s grade -- a distinct possibility, given the weakness of the Portuguese economy and the fact that the judgments of three other assayers of creditworthiness are all worse than DBRS’s -- it could trigger a renewed crisis in the euro area.

The ECB's purchases are arguably responsible for keeping Portugal's 10-year borrowing cost at an average of a bit less than 3 percent in the past six months. Compare that with Greece, which doesn't qualify for ECB assistance and has had an average yield of almost 9 percent since October, and it becomes clear how valuable ECB eligibility is -- and how financially damaging it might be for Portugal if it was shut out after a downgrade:

Surely Portugal can’t be a kind of simultaneously dead-and-alive-Schrodingers-cat? Surely it either is or isn’t investment grade, and therefore either should or shouldn’t qualify for the ECB program?

Unfortunately, rating assessments are fraught with subjectivity and bias, as the world learned to its cost during the credit crisis. Where one analyst sees a life-threatening debt-to-gross-domestic-product ratio, another may see indebtedness that’s merely troubling.

DBRS affirmed Portugal's investment-grade rank in February, but with some important caveats:

The high level of government debt remains a major challenge, exposing the country to shocks. Growth prospects remain modest, posing a risk to the sustained improvement in public finances. DBRS would be concerned if durable growth fails to materialize.

Portugal's annual economic growth rate slowed to 1.3 percent in the final quarter of 2015, down from 1.4 percent in the third quarter and 1.5 percent in the second. For the first quarter and second quarters of this year, economists are predicting a further slump to 1.2 percent. Unemployment, which peaked at 18.5 percent three years ago, is starting to tick up again, and rose to 12.2 percent in December from 11.9 percent at the end of the third quarter.

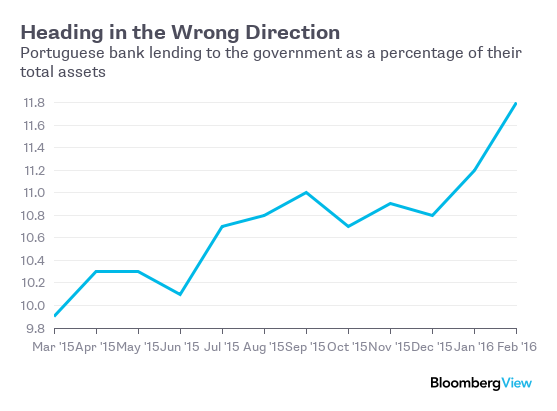

Moreover, Portugal's banks are becoming increasingly entangled in the government's balance sheet, according to figures compiled by Bloomberg Intelligence analyst Jonathan Tyce. The government's reliance on its banks via loans and bond holdings has surged in the past year:

About 80 percent of that Portuguese bank exposure to sovereign risk is to their domestic government, with much of the rest likely to be Spanish exposure, says Tyce. A rating downgrade and a sudden spike in Portuguese yields would have a knock-on effect, driving up borrowing costs for Spain and Italy.

With the ties that bind bank vulnerability to government risk still not severed, a downgrade would spell big trouble for a banking industry that's already in less than perfect shape.

It might not happen. DBRS may decide that Portugal is still investment grade. But with a debt burden that's still hovering around 130 percent of GDP, up from 84 percent at the start of the decade and double what it was 10 years ago, and an economy that seems to still be deteriorating, that'd be a brave stance.

Even if DBRS does junk Portugal, the ECB might finagle a way to keep it in the bond-buying program by finding an excuse to grant a waiver on the rating qualification. That, though, would almost certainly prompt protests from Germany. Greece may then demand a similar exemption.

EU officials, who failed to make progress at the weekend on how to address the issue of sovereign risk in the finance industry, may find themselves scrambling for cover as Friday puts Europe's debt crisis back in the headlines. And, once again, the ECB may find itself forced into political decisions that really aren't part of its mandate. At least (sarcasm alert) there isn't an important referendum looming that could see the union starting to break up.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

No comments:

Post a Comment