European investors seem more concerned than Americans about the possibility of a Brexit and the risk to U.K. bank bonds, according to Mizuho International Plc.

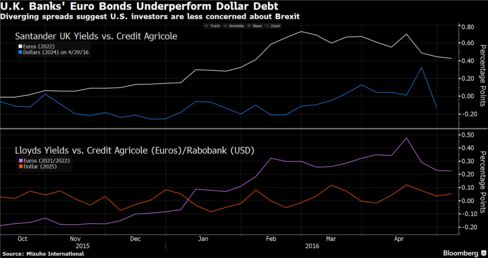

British lenders’ notes in euros have underperformed their dollar debt since last year, even taking into account foreign-exchange fluctuations. The premium investors demand to hold euro bonds issued by Banco Santander SA’s U.K. arm instead of similar Credit Agricole SA debt has widened to 43 basis points from about zero since October. By contrast, the difference in yields between the banks’ dollar notes is little changed.

“It’s different levels of skittishness about Brexit,” Roger Francis, a Mizuho analyst in London, said by phone. “European investors have a greater awareness of the issue and find it more alarming.”

Bonds at other U.K. lenders, including Lloyds Banking Group Plc, show similar patterns as the nation readies for the June 23 vote on whether to leave the European Union. A decision to quit may weigh heavily on domestic-focused banks, such as Santander UK Plc and Lloyds, if it leads to a slowdown in the the nation’s economy and real-estate sector, said Paul Dilworth, a fixed-income investor at Kames Capital Plc, which manages about 57 billion pounds ($83 billion).

The main exception to the diverging performance in U.K. bank bonds is Barclays Plc, according to Francis. Buybacks have helped tighten spreads on the lender’s euro notes, he said.

“European investors are leaning against U.K. names,” said Kames’ Dilworth. “We won’t get a decent recovery until the Brexit issue is totally out of the way.”

No comments:

Post a Comment