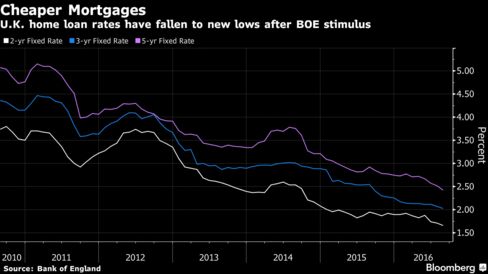

U.K. mortgage rates fell to records in August, a sign the Bank of England’s stimulus measures are reaching the economy.

The average rate on a home loan fixed for two years with a 25 percent deposit declined to 1.66 percent from 1.71 percent in July, the central bank said in London on Wednesday. That’s the lowest since the BOE began collecting the data in 1995.

The figures provide evidence that the BOE’s decision to cut its key rate to 0.25 percent on Aug. 4 is being passed on by lenders, after some banks initially declined to confirm they were going to reduce mortgage rates. While BOE Governor Mark Carney said institutions had “no excuse” not to pass on the reduction to customers, banks are finding it harder to offset the impact of record-low interest rates as their margins are squeezed.

Carney is due to testify to lawmakers at 2:15 p.m. London time and will probably face questions about the effectiveness of the central bank’s plans, as well as the Monetary Policy Committee’s assertion that most of its members would support a further rate cut this year, if the economy evolves as they predict after the decision to leave the European Union.

“The drop in mortgage rates through to August remains at least as large and quick as normal,” Allan Monks, an economist at JPMorgan in London, wrote in a note. “To the extent that the transmission of lower rates is working normally, even though the policy rate is at such low levels, the BOE is likely to feel emboldened in using this option further – if warranted by the macro backdrop.”

The rate on a three-year mortgage fell to 2.03 percent from 2.07 percent. On a mortgage fixed for five years, the cost decreased to 2.42 percent from 2.52 percent, and on a similar 10-year loan it declined to 3.02 percent from 3.05 percent. The average standard variable rate, a lender’s default rate, dropped 22 basis points to 4.33 percent.

No comments:

Post a Comment