The yen strengthened versus all of its G-10 peers as tensions in Asia ratcheted higher, with North Korea warning of a nuclear strike if provoked and President Donald Trump saying on Twitter that the U.S. would “solve the problem” with or without China. U.S. Secretary of State Rex Tillerson said during a Group of Seven meeting in Italy that Russia must abandon its support of Syrian President Bashar al-Assad’s regime.

“It seems like a perfect storm of factors re-pricing the reflation trade that we’ve seen since the election,” said Michael Lorizio, a Boston-based senior trader at Manulife Asset Management, which oversees about $343 billion. “As the global macro picture gets muddied a bit by some strong words from North Korea and the president’s tweets, that’s spooked markets that were already in a bit of a risk-off tone to begin with.”

Nine of 11 sectors were lower in the S&P 500, with real estate related stocks the only sector trading significantly higher. The widespread decline sent the the CBOE Volatility Index, or VIX, to the highest level since the U.S. presidential election.

What investors are watching:

- U.S. Secretary of State Rex Tillerson visits Moscow in an effort to persuade Russia that its alliance with Bashar al-Assad is no longer in its strategic interest.

- Federal Reserve Bank of Minneapolis President Neel Kashkari will participate in a Q&A at a meeting of the Minnesota Business Partnership.

- U.K. data on Wednesday is likely to show employment has remained steady while wage growth slowed.

- U.S. bank earnings begin with Citigroup, JPMorgan Chase & Co. and Wells Fargo early Thursday.

Here are the main moves in markets:

Currencies

- The yen gained 1.1 percent to 109.77 per dollar at 1:51 p.m. in New York, breaching 110 for the first time since November.

- The Bloomberg Dollar Spot Index fell 0.2 percent, while the euro rose 0.1 percent.

- The British pound was 0.6 percent stronger at $1.2484; data showed U.K. inflation’s upward trajectory paused in March.

Stocks

- The S&P 500 Index dropped 0.4 percent to 2,348.99. The benchmark gauge climbed less than 0.1 percent on Monday, while the VIX rose to the highest level this year.

- The MSCI All-Country World Index dropped 0.1 percent. Volumes in markets are down in a week that’s shortened in many countries by Easter holidays.

- The Stoxx Europe 600 Index finished little changed after trading at the highest since December 2015.

Bonds

- Treasuries climbed, with the yield on the 10-year note dropping six basis points to 2.31 percent after dropping as low as 2.29 percent.

- The yield on French 10-year bonds increased three basis points to 0.95 percent.

Commodities

- West Texas Intermediate oil rose 0.4 percent to $53.31 after jumping 1.6 percent on Monday.

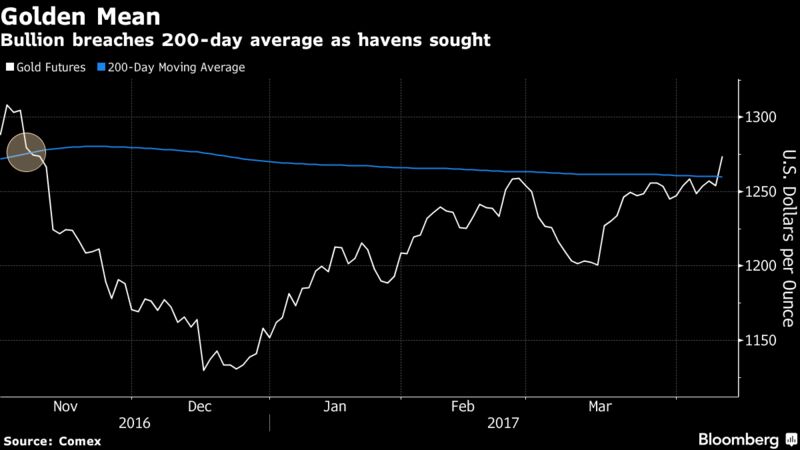

- Gold rose for a third day, adding 1.4 percent to $1,272.47 an ounce.

Asia

- Chinese equities traded in Hong Kong fell to a one-month low while Japan’s Topix slipped as the yen gained. Shares in Seoul extended the longest losing streak since June as tensions over both Syria and North Korea remain in focus.

- by

No comments:

Post a Comment