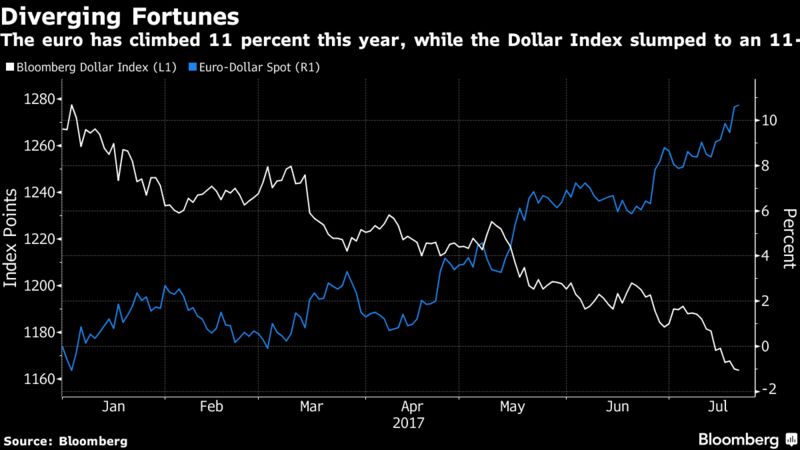

Bonds gained and the euro headed for a two-year high against the dollar on bets the European Central Bank will start tapering its stimulus program, with the greenback already under pressure from U.S. political developments.

The common currency gained impetus after ECB President Mario Draghi said Thursday that the central bank will discuss in the autumn any plans for tapering quantitative easing. The Bloomberg Dollar Spot Index fell to the lowest since August as investors assess an investigation into U.S. President Donald Trump that may stall his economic agenda. Stocks traded sideways, while copper led an advance in industrial metals and oil edged towards a second weekly increase.

Increased hawkishness from the ECB has helped the euro rally from lows last seen near the start of the millennium, with investors expecting tapering to start in the new year and pricing in a 10 basis point rate hike by September 2018. In the U.S., politics are again at the forefront, with reports that U.S. special counsel Robert Mueller is expanding his investigation of Trump less than a day after the president told the New York Times that any digging into his finances would cross a red line.

“Draghi tried to talk the Euro down, even going so far as to suggest that ECB’s quantitative easing could be increased and prolonged,” said Yann Quelenn, a market strategist at Swissquote Bank SA. “But the currency markets were not buying Draghi’s line, and neither are we. Available bonds are too scarce, and turn to a taper is too clear to disguise.”

Here are the main moves in markets:

Currencies

- The Bloomberg Dollar index was down 0.1 percent, in line for a weekly loss of 0.8 percent, at 9:56 a.m. in London, as the greenback weakened against most of its G-10 peers.

- The yen was up 0.2 percent at 111.74 per dollar.

- The euro climbed 0.2 percent to $1.1650 after reaching a 23-month high earlier in the session. The common currency has gained 1.6 percent this week.

Bonds

- The yield on U.S. 10-year Treasuries fell one basis point to 2.25 percent.

- Benchmark yields in Germany fell two basis points to 0.51 percent, down nine points this week. Yields in France dropped three basis points.

Stocks

- The Stoxx Europe 600 was little changed, with gains in oil and gas stocks balanced by a drop in auto stocks. The gauge is heading for its first weekly decline in three.

- Futures on the S&P 500 Index edged 0.1 percent higher after the underlying gauge closed flat Thursday.

Commodities

- Oil edged toward its second weekly increase as U.S. crude inventories continued to shrink. West Texas Intermediate was 0.4 percent higher at $47.09 a barrel.

- Copper advanced 1.3 percent to $6,038 a ton, a four month high, leading a rally in industrial metals.

- Gold was poised for its first back-to-back weekly advance since June 2. Bullion for immediate delivery added 0.2 percent to $1,247.52 an ounce.

- By With assistance by Natasha Doff

No comments:

Post a Comment