The value of Indonesia's rupiah has been particularly hard hit

Economic crises in Turkey and Argentina have led to talk of "contagion" - the danger of financial problems in one country spilling over into others.

Turkey has struggled with a falling currency and worsening relations with the US.

A spiralling crisis in Argentina prompted the government to announce austerity measures and to ask the International Monetary Fund (IMF) for an early release of a $50bn loan.

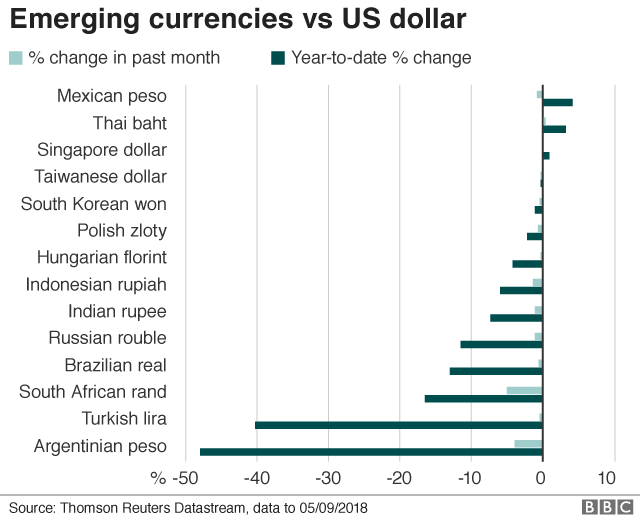

The sharp falls in the value of Turkey's lira and Argentina's peso have led to fears that currencies from South Africa to Russia will follow suit.

In Asia, India's rupee and Indonesia's rupiah have already been hit.

Put simply, contagion is a self-fulfilling process, whereby economic problems in one country prompt investors to sell assets in economies with similar risks.

In a globalised world, a crisis in one country can also quickly spread to others through trade links or lending by banks.

That is why a downturn in Turkey or Argentina matters to foreigners - beyond making holidays there cheaper.

How can problems spread?

Trade is the obvious way for trouble in one country to affect another.

When an economy begins to falter, companies tend to cut production and then jobs. As a result, consumers have less money to spend on goods, including imports. This is bad news for global businesses that export a lot of goods to the country.

If a crisis also causes a country's currency to weaken, the cost of imports rise, further hurting demand.

However, Joseph Gagnon at the Washington-based Peterson Institute for International Economics, says Asia has "very low trade links" with Argentina and Turkey, "so that is not much of a worry".

Rajiv Biswas, Asia Pacific chief economist for IHS Markit, also says trade with Turkey is an unlikely channel of contagion for Asia, since the region relies more heavily on big economies such as China, Europe and the US for their exports.

"The more significant concern for Apac [Asia Pacific] nations would be if the Turkish economic crisis results in contagion to emerging markets currencies and equities, which could potentially trigger significant capital outflows from emerging markets," he said.

Why are other emerging markets suffering?

The phrase "emerging markets" refers to developing countries in Africa, Latin America or Asia, while major economies such as the US, the UK and Japan tend to have higher living standards and more developed financial systems.

During an economic crisis, investors tend to sell riskier assets, such as emerging market currencies or stocks, and hold on to safer ones, such as the US dollar or government bonds issued by major economies.

Julian Evans-Pritchard, a senior China economist at Capital Economics, says countries that rely on money from overseas and have foreign inflows of cash into their stock and bond markets are particularly at risk of contagion.

"The risk is that when sentiment turns more negative, foreign investors start to pull out those funds, which has an impact on the exchange rate," he said.

"For countries that borrowed a lot in foreign currency, usually in US dollars, this can make it difficult for them to repay their foreign currency denominated debt. That's what happened in 1997 during the Asian financial crisis, for example."

Why have India and Indonesia been hit?

In Asia, both India and Indonesia rely heavily on foreign capital inflows, which is why their currencies have suffered in particular.

India, an oil importing country, has seen its import bill rise along with higher oil prices and this has caused its current account deficit to widen, said Mr Biswas of IHS Markit.

A country that runs a current account deficit may rely on inflows of foreign money to finance spending and investments.

Indonesia, meanwhile, has low foreign exchange reserves and a high level of foreign ownership in the local equity and bond markets, Mr Biswas added.

This makes it particularly vulnerable to investors pulling their money out of the country.

How about bank exposure?

Another way contagion can spread is when banks in one country own assets in another country which is in trouble. The economic problems can cause the value of these assets to fall.

When that happens, investors worry how a bank will cope with the falling value of the assets, and how this will affect its ability to lend money to consumers and other borrowers.

Such concerns weighed on European bank shares recently, with investors worried about how much Turkish assets they own.

The Financial Times reported that a wing of the European Central Bank was concerned about the exposure of some of the eurozone's biggest lenders to Turkey. The report said Spain's BBVA, Italy's UniCredit and France's BNP Paribas, all of which have significant operations in Turkey, were particularly exposed.

Turkey's currency fall led to concern over banks' exposure to the economy

Spain's banks are the most exposed to Turkey, according to IHS Markit, citing data from the Bank for International Settlements.

They have about €81bn of exposure to Turkish assets, and French banks have exposure to about €35bn.

But IHS Markit's Mr Biswas said Asian banks' exposure to Turkey was limited.

"In the big picture of the banking sectors of the Asian countries, this would not be a serious negative factor in their outlook," he said.

No comments:

Post a Comment