U.S. equities gained at the start of a week filled with potentially significant catalysts from central bank meetings, geopolitical developments and economic data. Treasuries and the dollar drifted lower.

The S&P 500 and Nasdaq opened slightly higher, while Dow contracts slipped as Boeing Co. declined on reports that the U.S. Transportation Department was examining the 737 Max’s design certification.

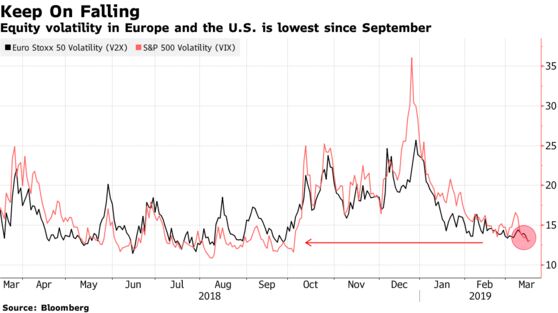

Equities are grinding higher and volatility is declining on expectations the Fed will point the way to just one rate hike in 2019 when it meets later this week. Other central bank gatherings, including for the Bank of England, will give further clues on monetary policy. In politics, investors are keeping an eye on this week’s Brexit developments as the British prime minister works to win support for her divorce agreement.

“The stock market has priced in a very dovish Fed and a stabilization of U.S. and global growth,” Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter, wrote to clients. “Both expectations need to be met by the events this week in order for this rally to keep going.”

European stocks nudged up, led by miners and lenders as Deutsche Bank AG and Commerzbank AG got the green light to proceed with negotiations on a tie-up. In Asia, Chinese and Hong Kong shares led the advance. The pound fell as Prime Minister Theresa May continued to face opposition to her Brexit plans.

Elsewhere, oil fluctuated as OPEC and its allies recommended deferring a decision on whether to extend oil production cuts until June. Emerging market currencies and shares climbed. Gold gained.

Here are some key events coming up:

These are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Sophie Caronello, and Adam Haigh

No comments:

Post a Comment