Interest rate increases could be "more frequent" than expected if the economy performs as the Bank of England is expecting, governor Mark Carney says.

The markets are forecasting just one interest rate increase by 2021.

But if there is a resolution to the Brexit impasse, and inflation and growth continue to pick-up, then more increases are likely, Mr Carney said.

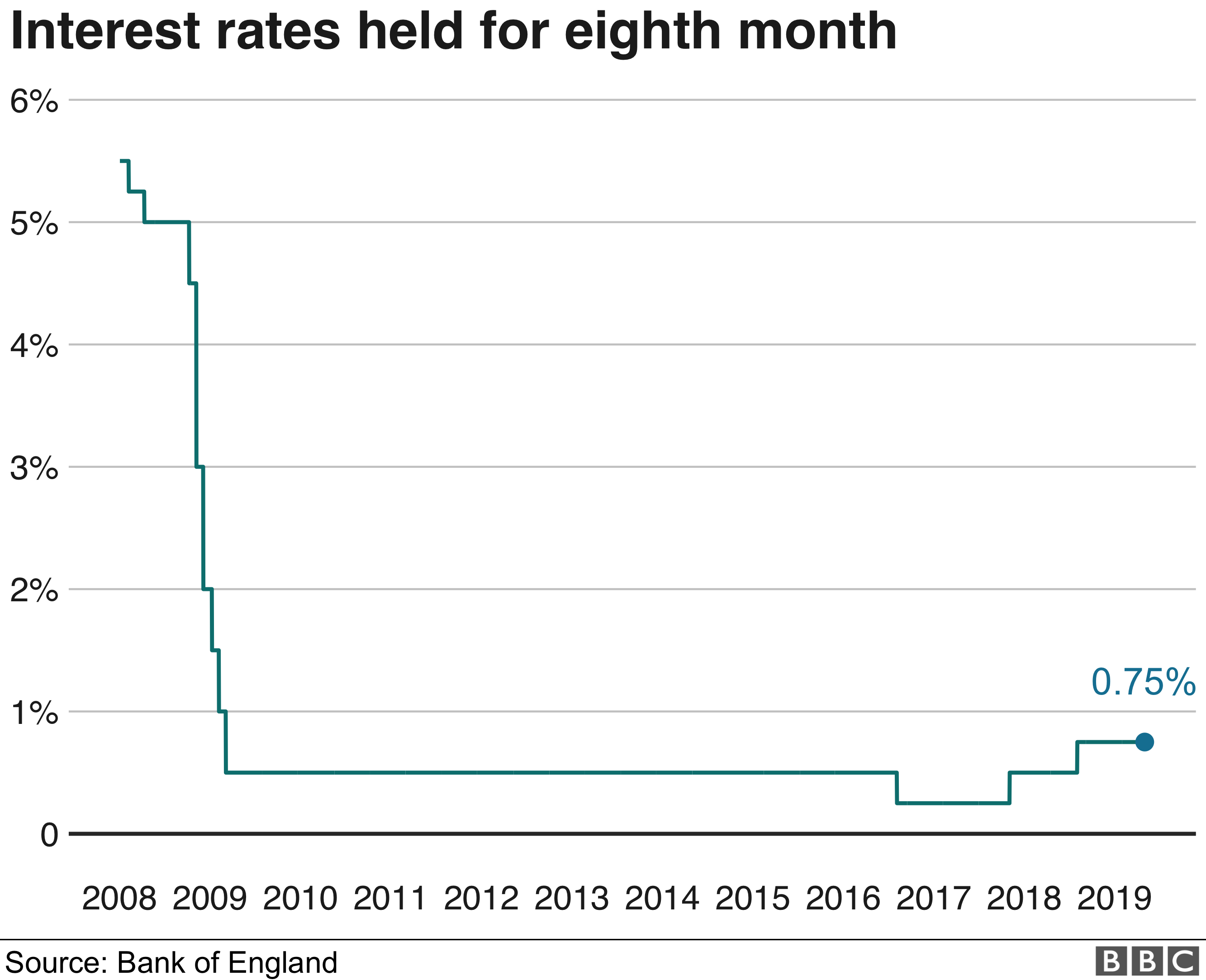

As expected, the Bank kept interest rates on hold at 0.75% at its latest policy meeting.

Interest rates have been at that level since last August, when the Bank raised them by a quarter of a percentage point.

The Bank is expecting growth and inflation to pick up over the next two years.

In a news conference, Mr Carney said: "If something broadly like this forecast comes to pass... it will require interest rate increases over that period and it will require more, and more frequent interest rate increases, than the market currently expects."

The Bank's forecasts are based on a "smooth adjustment" to any new trading relationship with the European Union.

What did the Bank say about the economy?

In its Quarterly Inflation Report, the Bank of England raised its UK growth forecast for this year, in part because the outlook for the global economy is a bit brighter.

The Bank now sees growth of 1.5% this year, up from February's forecast of 1.2%.

Economic growth has been subdued since the UK voted in June 2016 to leave the EU.

In particular, business investment has been falling.

The Bank says stockpiling has been giving the economy a short-term boost, but for this year, the strengthening of the global economy will have a more important effect.

In the minutes from its latest policy meeting, the Bank said "global growth had shown signs of stabilisation, and had been a little better than expected".

It also forecasts the unemployment rate will continue falling in the coming years to 3.5% by 2022, which would be the lowest rate since 1973.

Will the Bank raise interest rates soon?

The Bank is reluctant to move interest rates until there is further clarity, not least about the path of Brexit.

For as it highlights (again), the movement in rates then could be "in either direction", depending on the outcome, the impact on the economy and whether it decides to support growth or inflation.

If all goes smoothly, then the Bank is likely to turn its firepower on inflation and proceed with raising rates "at a gradual pace and to a limited extent" - especially if there's a bounce in investment and hiring.

At the moment, the MPC reckons "the cost of waiting for further information is relatively low".

But that, given the degree of inflationary pressure it's forecasting, is quite a gamble.

If the Bank has missed the boat, then rates might have to ultimately rise faster and by more than originally envisaged to curb inflation.

That would be an unenviable parting gift from Mr Carney to his successor.

What does it mean for mortgages?

Moves in interest rates are important to the 3.5 million people with variable or tracker mortgages.

Even a small quarter-point rise can add hundreds of pounds to their annual mortgage costs.

Mortgage market experts say that for those who can afford to buy a home, now is a good time to borrow.

"Right now, you've got lenders that want your business and rates are exceptionally low," said David Hollingworth, from L&C Mortgages.

Some lenders are offering five-year fixed deals at below 2%, he said.

Even borrowers with a small deposit can find competitive rates of interest, he added.

What is the outlook for the housing market?

The Bank expects a fall in UK house prices this year, with property values predicted to drop by 1.25%.

It says some households are likely to have delayed moving house because of Brexit uncertainty.

It also says that affordability is also slowing the market, particularly in areas where prices are high, such as London and the South East.

When will Mark Carney step down?

Last month, the government launched the recruitment process for a new governor for the Bank of England.

Mark Carney will step down on 31 January 2020 after more than six years in the post.

Interviews will be held over the summer and the appointment will be made by the government in the autumn.

The government is under pressure to consider female candidates, as men hold the Bank's key positions.

At the moment, the Monetary Policy Committee, which sets interest rates, only has one female among its nine members.

When asked about the lack of diversity at the Bank, Mr Carney said "big progress" had been made with women now making up 31% of senior management.

No comments:

Post a Comment