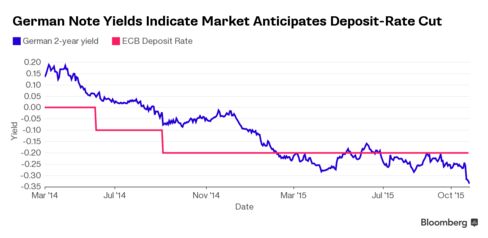

Euro-area government debt totaling $345 billion that yields less than minus 0.3 percent shows investors are looking to the European Central Bank to cut its deposit rate by a further 0.1 percentage point.

As bonds advanced across the euro zone on Tuesday, the yields that investors accepted for these very securities support the view of lenders including Deutsche Bank AG and BNP Paribas SA. The banks forecast the deposit-rate cut after ECB President Mario Draghi last week said central-bank policy makers discussed a reduction to the current rate of minus 0.2 percent, and that the officials would reexamine the scope of their quantitative-easing plan in December.

Source: Bloomberg

The ECB has ruled out buying bonds with yields below its deposit rate, which officials cut to its current level September 2014. Yet the prospect of a further reduction has helped push yields on short-dated debt still lower.

That’s because a lower deposit rate would increase the number of bonds available for the ECB to buy under QE, and traders seem to be jumping ahead of the central bank. Yields on German two-year notes dropped below minus 0.3 percent as Draghi spoke on Oct. 22.

“We’ve come a long way and now are priced about 50 percent or more for a 10 basis-point cut in December,” said Christoph Rieger, Commerzbank AG’s head of fixed-income strategy in Frankfurt, who says a reduction in the ECB rate for overnight cash is not his base case. “At this level, the market is holding its breath, waiting for more fundamental confirmation.”

Two-Year Yield

Germany’s two-year note yield declined one basis point, or 0.01 percentage point, to minus 0.34 percent at 3:38 p.m. London time, after touching a record low of minus 0.348 percent on Oct. 23, the day after Draghi’s comments. That compares to a five-year average of 0.268 percent. The price of the zero percent security due in September 2017 was at 100.64 percent of face value.

A negative yield means investors buying the securities now will get back less upon maturity than they paid.

There’s about $6.4 trillion of securities in the Bloomberg Eurozone Sovereign Bond Index, of which about 5 percent is yielding minus 0.3 percent or less.

The recent slide in yields is not limited to German debt, nor to short duration. Finland’s two-year note yield slipped to minus 0.319 percent on Tuesday, the lowest since 2001, when Bloomberg began recording it. Germany’s 10-year yield dropped five basis points on Tuesday to 0.45 percent, and touched 0.44 percent, the lowest level since May 5.

QE Effect

The introduction of the ECB’s QE program pushed the average euro-region bond yield to a record low of 0.4252 percent in March, before it rebounded in the following months, according to a Bank of America Merrill Lynch index.

The increased yields now present a challenge for policy makers, as they risk pushing the euro higher, which may threaten their efforts to revive inflation and economic growth in the 19-currency bloc. The index’s average yield was at 0.6434 percent on Monday.

by Lucy Meakin

No comments:

Post a Comment