Crude consumption.

Photographer: David Paul Morris/Bloomberg

Lower oil prices were roundly celebrated as a tailwind for global growth.

In theory, the movement of wealth from commodity producers, which often stow away oil revenue in sovereign wealth funds, to consumers, which spend a far larger portion of their income, is a positive for economic activity.

But strategists at Credit Suisse believe that so far, the global economy has seen only the storm from lower crude, not the rainbow that follows.

"The fall in the oil price was considered by many investors, and ourselves, to be a significant positive for global GDP growth," a team led by global equity strategist Andrew Garthwaite admitted.

The net effect of this development, according to their calculations, has turned out to be a 0.2 percent hit to the global economy.

Credit Suisse

The negative effects of lower oil—namely the large-scale cuts to capital expenditures—are having a large and immediate impact on global gross domestic product.

"The problem is that commodity-related capex accounts for circa 30 percent of global capex (with oil capex down 13 percent and mining capex down 31 percent in the past 12 months)," wrote the strategists, "and thus the fall in U.S. and global commodity capex and opex has taken at least circa 0.8 percent off U.S. GDP growth in the first half 2015 and circa 1 percent off global GDP growth over the last year."

Garthwaite and his group highlight three other channels through which soft oil prices have adversely affected the American economy: employment, wages, and dividend income.

Employment in oil and oil-related industries has declined by roughly 8 percent since October 2014, with initial jobless claims in North Dakota, a prime beneficiary of the shale revolution, at extremely elevated levels.

During this period, average hourly wages for those employed in oil and gas extraction shrank nearly 10 percent after growing at a robust clip in the previous two years.

And the payouts to investors who own oil stocks have also been cut, which Credit Suisse deems to be a modest negative for household income.

"A fall in capex brings with it a fall in direct employment and earnings (total payroll income in the U.S. energy sector is down by 18 percent since November last year, for example), as well as second-round effects on other industries servicing the capex process, from machinery producers to catering and hotels," the team wrote.

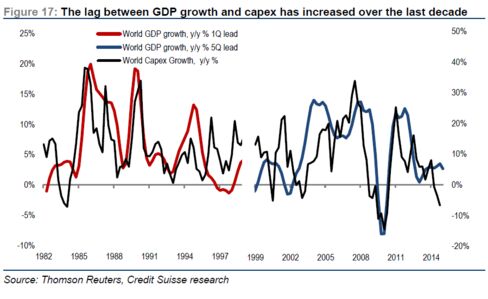

The team also found that the declines in capital spending have much less of a front-loaded shock on growth than in the 1980s, the decade in which we last saw a supply-driven plunge in oil prices:

Credit Suisse

"As a result, even once the oil price has decisively troughed, the lag in both cutting (and re-starting) capex projects is such that capex could remain a drag on GDP for a number of quarters," wrote Garthwaite's team.

On the flip side, the positive effects for consumers have been slow to manifest, best depicted through the rise in the percentage of income consumers elect to save.

This rise in savings ratio in the U.S., Japan, and continental Europe speaks to concern about the how long these lower gas prices will endure. If households believe the relief at the pump is only temporary, they're less likely to deploy those funds in more discretionary areas. Garthwaite and his team note that consumers are coming around to the notion that lower oil prices might be a permanent development and are loosening their purse strings.

As such, Credit Suisse maintains that lower oil prices will eventually prove to be a net benefit for global growth that—thanks to the transfer of wealth to entities with a higher marginal propensity to consume—as well as the prospect for more accommodative fiscal and monetary policy linked to softness in crude.

No comments:

Post a Comment