U.S. equity futures erased a gain, Treasuries extended their advance and the dollar turned lower after American data including retail sales and jobless claims disappointed. European stocks were flat as investors digested a slew of company earnings.

Contracts on the Dow Jones Industrial Index, S&P 500 and Nasdaq all traded little changed after poor data, including the worst drop for retail sales in nine years, added to signs that U.S. economic growth is cooling from prior quarters. Coca-Cola fell in pre-market trading after results showed it sold fewer drinks in the Americas in the fourth quarter.

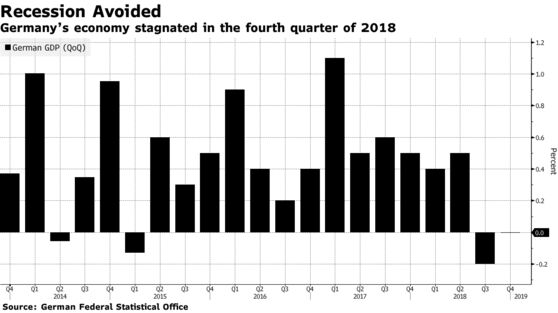

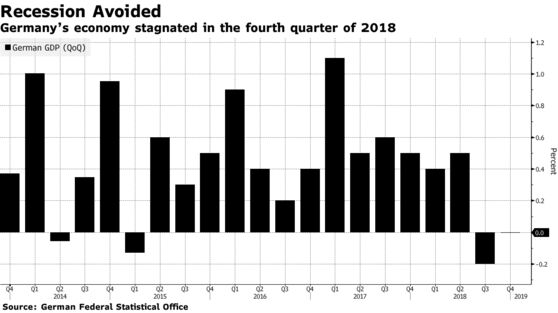

Food and industrial-goods shares had spurred the Stoxx Europe 600 Index amid a slew of company news, but it tracked the move of U.S. futures. Equity benchmarks drifted in Japan, China and Australia, and ticked lower in Hong Kong. European core sovereign bonds rose and the single currency strengthened after data showed the euro region’s biggest economy stagnated in the fourth quarter, but dodged recession.

Earlier shares had gained on reports President Donald Trump is considering pushing back the deadline for imposition of higher tariffs on Chinese imports by 60 days, as the world’s two-biggest economies try to negotiate a solution to their trade dispute. Trump also told reporters that trade talks are making good progress, helping to steady investor sentiment.

Elsewhere, emerging-market shares and currencies fell. Russia’s 10-year bonds dropped the most since since November after the U.S. Senate introduced sanctions legislation targeting the country’s banks and state debt.

Oil continued its rebound as falling shipments from Saudi Arabia and Venezuela outweighed gains in U.S. crude stockpiles. And the pound weakened while gilts advanced ahead of Parliament’s latest set of voteson Theresa May’s Brexit strategy, and after dovish remarks from a Bank of England policy maker.

Here are some key events coming up:

These are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Andrew Dunn, April Ma, and Adam Haigh

(An earlier version corrected direction of share move in first paragraph.)

No comments:

Post a Comment